Non-fiction lesson books are always a good read because they help us in making important decisions in life. Psychology books are also intellectual books that give us a detailed explanation about our behaviors, actions, trauma, and so much more.

Knowing about the psychology of something is very important in order to live a smart life. The Psychology of Money is one of the best books that tell us the psychological influence money has on us. Once you know the psychology behind money, it becomes easier for you to earn and spend wisely in a capitalist world that keeps on tempting people to earn more and spend more.

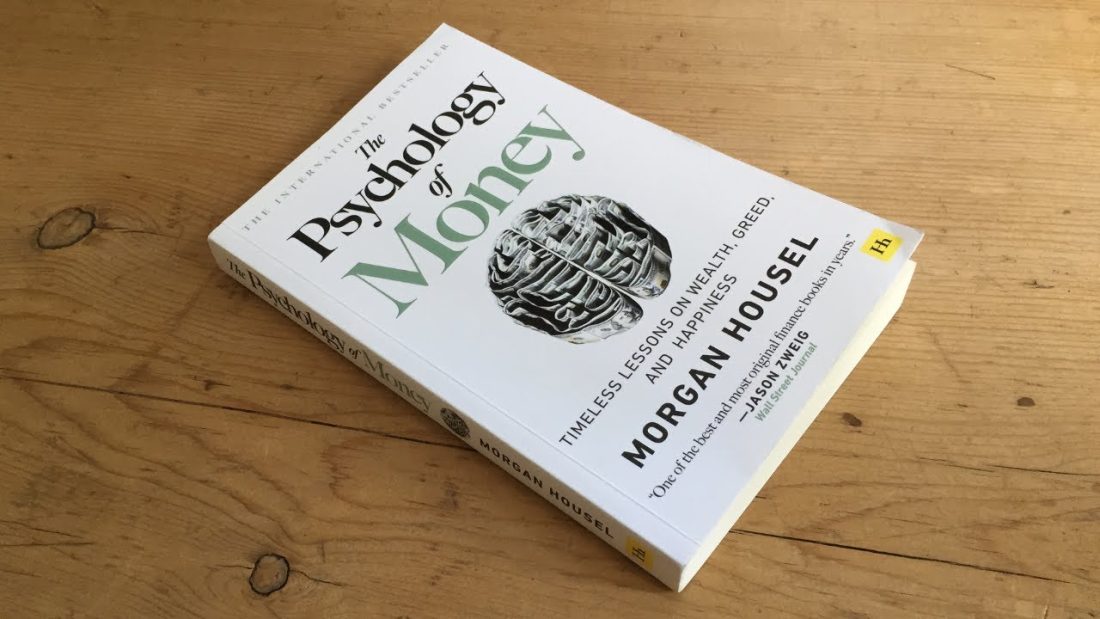

If you are interested in reading this book or are hesitant about reading this book, here is complete detail about The Psychology of Money:

What is The Psychology of Money about?

The book The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness is written by Morgan Housel published on 8 September 2020. It is widely read all around the world for its genius explanations and references by the author.

The book is like life lessons that you would want to remember for the sake of living a fulfilling life. The book teaches us how you can establish a good relationship with money without losing your path and goals. Your financial decisions make your future, therefore, it is important that you invest in the right things that can reward you later.

The Psychology of Money genre

The Psychology of Money is a non-fiction and self-help book. The book is more about self-development as you enter adult life. As an adult, it is essential that what you are earning gives you back later in life when you are unable to make money. The book gives timeless lessons to the reader to be happy and not revolve happiness around money and wealth.

People might convince you that making money and having huge wealth makes a person successful. It might make you feel frustrated and worried about your success. This book is a self-help that convinces you to slow down in life without worrying about making money.

Lessons from The Psychology of Money

Once you read The Psychology of Money your views about money change drastically. Many readers have said that this book can change the way money is seen and give importance to it when it isn’t.

Every person spends money differently

One of the most important lessons learned from this book is that since every person is born in different situations, everyone has a different way of spending money. You might consider a person spendthrift or frugal, but this is normal.

Every individual’s perception about money depends on what era they lived, which economy they survived or are surviving in, which family they were born in and so much more. Everyone has their own values and ethics about spending money that no other person has the authority to judge or comment on.

Every person “learns very different lessons” and spends based on those lessons. So next time you see someone spending money on anything useless, it might hold meaning to them and not to you.

You can be influenced by who you admire

The book quotes that your way of spending and earning money is influenced by the people or celebrities you admire.

When we set our standards to become like Jeff Bezos or Elon Musk, we become unhappy and ungrateful. The advertising and PR articles do not highlight the struggles and sacrifices those people gave to reach the top, this makes us feel sad. Every individual has a story of hard times and hurdles they face that the media and internet refuse to highlight. Instead, they glorify those figures that have a negative impression about how we view ourselves.

Our standards become too hard to reach, and we forget to spend our moments with what we have. The book teaches us to be careful about who we make our role models.

Being grateful for what you have

In the age of the internet and social media, people love to show off their wealth. There are people who always remain ungrateful with what they earn. This can cause unhappiness and depression. When we compare our wealth with others, it makes us feel unsatisfied with our life.

This is what the book terms “Social Comparison”. This social comparison does not pause, instead, it keeps on climbing up until it is out of reach for anyone. They either give up trying and be satisfied with what they have or keep striving to reach that peak again and again.

Furthermore, when you live in a capitalist world, you always want the latest gadget or technology just for the sake of it. This makes you feel overwhelmed and frustrated. The book teaches us that we have to be grateful for whatever we have to live a healthy life.

When you raise your expectations, you need to put in extra effort to earn more. Although there is nothing wrong with being ambitious and putting in extra effort, once you become over-ambitious, your satisfaction in having enough decreases.

Invest your money

One thing that young people do not do is invest money when they start earning. They are so driven by spending money on useless timely things that they are left with nothing when they are old.

The book uses the example of the investment by Warren Buffett that continued for decades until he earned enough to become a rich millionaire. It is his earlier decisions and investments that made him successful. So, whatever you earn, invest in things that can give you mutual funds later in life, namely compound interest.

You can invest in bitcoin, or buy shares, or anything in general that gives you interest on an annual basis that you can profit off from.

Plan and change of plans

The book tells us that no plan can be successful if you strictly stick to it. It is good to have plans and live a planned life, but do not expect that your life will go as you planned. Every plan needs to be modified and changed according to the situation you are in.

When you plan, you have to prepare yourself for it to fail as well. Of course, you can work hard to reach the goal of the plan. But if it does not work your way, you should let it go, or change it.

Luck and risk go hand in hand

You might be convinced that only hard work and dedication can take you places. But sometimes, luck is also by your side. This book highlights that luck has a role in the choice you make.

If you make bad choices but still end up successful, then it is purely because of your luck. Luck gives you the opportunity to reach success. The risk you take can be recovered or lost based on your luck, and this is the reality that everyone should accept.

No matter how many stats you calculate, the prediction is not always right, it is your luck. You might have thought you made a bad decision, but it might end up being a good one.

The key is to never be pessimistic if things do not work out. You will have to put efforts that might go to waste, but some efforts might end up being rewarding.

Staying wealthy is the real challenge

When you make investments and earn a profit, you get greedy to invest more than the limit you have set. This is how you end up losing money. The market tempts you to spend more money, but you have to know your limits.

The book says you can easily become rich, but remaining rich is the real challenge. You have to be frugal and paranoid all the time to make sure your money stays with you and gives you profit.

Take Charge of Your Life: Break Free from Money’s Grip

Money can wield control over your life, but you hold the key to liberation. Discover how to reclaim your freedom from financial constraints. Earn with purpose; let money buy you time and autonomy. Surround yourself with the right people, doing what you love.

Everyone is struggling for wealth

Wealth is something everyone struggles with. Your wealth is nothing people want, it is what people desire to be admired.

The biggest drive for having wealth is to show off and be admired by others. It used to exist since ancient times, and it is prominent in today’s world as well. This is the psychology of money that humans are trapped in, it’s in human nature to be admired. But what people do not realize is that they end up giving up their freedom and happiness.

But the truth is no one cares if you have billions worth of wealth if your personality is not admirable. If you seek admiration and love from people, it does not come from wealth but from your actions.

Financial independence should be your goal

When you earn money, financial independence should be your goal. The book elaborates that saving money is your financial independence. The concept of living your life to the fullest does not mean spending all your earnings in one go.

You should develop the habit of keeping money aside and save up at all times. This can be done by planning a budget or setting limits to your spending. You can even open a separate bank account just to save up.

By saving up, you can be financially independent later in old age when you no longer have the energy to work. The ultimate goal of money should be financial independence.

You cannot always be right

Errors and mistakes are something everyone makes in life. No one is born perfect and you learn from your mistakes only. This book shows through various examples that mistakes can be a pathway towards success.

You might be new to something and have information about it. As long as you are making reasonable decisions with careful steps, mistakes can be forgivable. You should never dwell upon errors because they distract you from gaining more.

You should always be optimistic in life and grateful for what you have.

The Psychology of Money quotes

There are different quotes in the book that need to be highlighted. Those words leave a big impression on the reader because of their impact.

Here are some of the best quotes in the Psychology of Money:

1. “Money’s greatest intrinsic value—and this can’t be overstated—is its ability to give you control over your time.”

As mentioned before, the book describes time as a precious entity that can be bought through money. If you understand the value of money wisely, you can use it in your favor to control your freedom.

2. “Spending money to show people how much money you have is the fastest way to have less money.”

Showing off money will cost you a fortune because you would want to buy things as expensive as they can be without a second thought. Running out of money is not difficult because there are dozens of ways to do it.

3. “…doing something you love on a schedule you can’t control can feel the same as doing something you hate.”

The key to the success of wealth is to earn in a way that you have time to yourself whenever you want. This does not mean you should stop earning and find ways to waste time, but to align your money towards the direction of it.

4. “Napoleon’s definition of a military genius was, “The man who can do the average thing when all those around him are going crazy.”

You have to live smart, not hard to be successful. People who are smart in their ways are the ones who climb up the social stratification ladder in no time. You might be convinced that working hard can take you to places, but if you are not smart about where to put that effort, there is no use for it.

5. “Nothing is as good or as bad as it seems.”

Your mentality and optimism play an important role in life. If you keep thinking about the worst things, the things that are not worse will look bad to you and vice versa with the good things. As long as you keep thinking that it is normal and you can always try again, nothing can stop you from being successful.

6. “Plan to survive reality. Future filled with unknown is everyone’s reality.”

Planning never works in your way. You can never live a calculated life because unexpected situations come and go all the time that are unlike your plan. It is good to have plans, but you should not expect that plan to always be right in the path. The author wants you to not beat yourself up with the thought that if your plan is not working, that does not mean you are a failure because the future is unknown.

7. “Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.”

Greed and obsession over money can change the way you look at the world. If you revolve your happiness around money, you will only be happy when you have money. On the other hand, if you know the psychology of money, you will be able to view the world better.

8. “There are many things never worth risking, no matter the potential gain.”

Sometimes we think that if we have gained money from somewhere, investing there again with an even bigger risk can backlash you. You have to think twice before you spend money, whether it is worth risking or not. In a capitalist world, there are many things that are not worth risking but are shown in an exaggerated way to force you. When you are smart, you do not invest in things that are not worth it.

9. “Good investing is not necessarily about making good decisions. It’s about consistently not screwing up.”

Your decisions can influence your money game but not always. Sometimes bad decisions can also lead to gain. You just have to think smart and make the decision whether you think it is good or bad. Furthermore, making investments in the right places will not screw you up, so you have to do your research always.

10. “The highest form of wealth is the ability to wake up every morning and say, “I can do whatever I want today.”

When working hard, you have to make sure your hard work is paying you well in return in the form of time. The main wealth that you should aim for is to have the freedom to do whatever you want and whenever you want without a second thought.

11. “Bill Gates once said, “Success is a lousy teacher. It seduces smart people into thinking they can’t lose.”

Losing is gaining something in return as well. Success cannot be defined by seeing money but by the behavior of the person. You can have billions of dollars but still, be miserable if you think being a trillionaire is a success.

12. “Richard Feynman, the great physicist, once said, “Imagine how much harder physics would be if electrons had feelings.” Well, investors have feelings.”

Money investment is not like math. You do not get fixed values to solve for a definite answer. Investors can change their minds or some situation may arise that can influence the investment, so you have to always be ready for the worst but remain optimistic.

13. “Optimism sounds like a sales pitch. Pessimism sounds like someone trying to help you.”

Pessimism can bring down a rich man to the ground within days. It makes a person weak and hopeless to give up things they already have. Optimism means you will find ways to make money and gain wealth. As an investor, you have to be optimistic at all times.

14. “Modern capitalism is a pro at two things: generating wealth and generating envy.”

Capitalism tempts you to work and spend on useless things. It generates envy in people to desire what the other person has. This can have a negative toll on the mental health of people because they think they are miserable and useless. The best way to use capitalism in your favor is to generate wealth without giving importance to shiny things and show off.

15. “An underpinning of psychology is that people are poor forecasters of their future selves.”

The future you defined as a child can never be satisfying when you are an adult because your mental state and thinking change with time. It’s good to dream about becoming something, but not to dwell over yourself if you don’t reach it. You can develop a liking for other things and be successful in them. Humans cannot really forecast their future with definite results because they sometimes end up being wrong.

Unlocking Financial Wisdom: Why You Should Dive into “The Psychology of Money”?

“The Psychology of Money” proves invaluable by unraveling intricate financial and psychological insights in one comprehensive read. Readers glean profound understanding of worldly and mental dynamics, fostering a paradigm shift.

Its enduring popularity stems from its ability to unveil not just money management strategies, but also the intricacies of human behavior and mindset. Dispelling wealth misconceptions, it emphasizes leveraging time as the ultimate asset, facilitating freedom through compound interest.

Delve into this nonfiction gem to grasp pivotal concepts that reshape your financial outlook and life philosophy. Its teachings extend beyond wealth acquisition, nurturing a mindset geared towards long-term prosperity and fulfillment.