If you want to send someone a certain amount of money but do not wish to send them a personal cheque, or if you do not have a checking account, you can still send the cash. How can you do that? You can buy a money order at banks, the post office, or supermarkets. You must be wondering what a money order is: a secured cheque. Moreover, You pay for it upfront and give a certain fee, and the recipient cashes the money order at their bank. How long is a money order good for? Do money orders expire? But banks typically follow similar guidelines for cashing them as they do for cashing cheques. Continue reading the article to learn more.

How Long Is A Money Order Good For?

Each money order issuer has set its own individual expiration or termination arrangements. Typically, your money order would not lapse. However, its value will deteriorate when it is somewhere in the range of one to three years old. If it has been this long since the purchase and the money order still has not been cashed, the issuer will charge service expenses when you try to cash or refund it. It means that it will be worth less than what it was at the hour of procurement. Administration expenses ordinarily accumulate monthly, so the more you hold on to resolve the issue, the more your money order value will keep decreasing.

The Uniform Commercial Code (UCC) is a set of laws and rules designed to harmonize sales and regulatory legislation across the United States. The UCC informs banks that they are not required to accept personal or company checks that are not required to carry personal or company checks over 180 days old (6 months). Therefore, personal and company checks usually have a validity of six months; however, certain institutions may accept more senior checks.

You should contact your bank to confirm their policies if you discover an old check made out to you. Consider placing a stop payment on an uncashed statement if you wrote one. After that, you should contact the check’s receiver to ask whether they’d want a new tab to replace the previous one.

How long are various check kinds valid for?

Checks come with a variety of expiry dates. Although it is a general guideline, not all checks and money orders fall within the 6-month rule.

How much time do personal checks last?

Payroll, corporate, and personal checks expire after six months. Some companies pre-print “void after 90 days” on their statements. The pre-printed phrase encourages individuals to deposit or cash an examination as soon as possible, even though most institutions would honor those checks for up to 180 days. It’s essential to cash or deposit a bill you’ve received as soon as possible.

If you keep a check around for a while, there’s a chance the account number or routing number may change, or the person who wrote the review might have lost track of it and used the money for something else. You would have to pay fees for returned checks due to this.

How long are American treasury checks valid?

U.S. treasury checks are valid for one year from the check’s date by law. Since the U.S. treasury issues federal tax refund checks, they are valid for a year. You can still receive the money the government owes you beyond that point, but you’ll have to get in touch with the check’s issuer and ask for a replacement.

How long are local and state government checks valid?

According to state legislation, checks from state or municipal government organizations will expire. Therefore, the validity of a state tax refund check varies from state to state, but typically, it lasts between six months and a year. You should contact the form and ask for a new statement if your state tax refund check has expired. You still have a right to receive the money the government owes you, just like with federal checks.

When you get a check from the government, sift through it and search for anything that indicates the expiration date. The best action is to deposit or cash the check before it expires.

How long do cashier’s checks last?

Image Source: Experian

The regulations governing cashier’s checks, a sort of “official check,” can be challenging. Cashier’s statements have no predetermined or outlined expiration date. Some argue that cashier’s checks never expire, while others maintain that they do so after 60, 90, or 180 days. Since the issuing bank backs the cashier’s checks, they should be good as long as the bank is in business. However, some institutions will include expiration dates on the checks themselves.

It could be challenging to cash a cashier’s check that has perhaps expired or to obtain a new cashier’s check. If you get a cashier’s check, cash it or deposit it before the “void after X days” warning kinks in. If you come across an old cashier’s check, contact the bank that issued it and find out what they need from you to complete the transaction. Cashier’s checks are a unique kind of check that is frequently applied to more significant transactions.

How long do money orders last?

Money orders have an expiration date determined by state and issuer regulations. Money orders typically have no expiration date. However, they could get so old that they are considered abandoned property and subject to laws, or fees may deplete the value. It’s crucial to read the tiny print that the issuer provides. The western union will assess a fee on the money order’s weight after one to three years.

Eventually, the money order will be useless if this continues. USPS money orders never lose value and have no expiration date. You may cash a U.S. postal service money order everywhere there are post offices. Please be aware that western union or USPS policies are subject to change anytime. Contact the person who issued it to determine if your money order expires or is subject to costs for using an outdated money order. It can replace checks with money orders, often used for smaller transactions.

When do traveler’s checks expire?

Traveler’s checks are perpetual. If you still have some old traveler’s checks, you may cash them there or use them strictly as you would at home. Traveler checks are still enforceable if the issuing bank is still operating.

Issuer Guidelines to Observe

No government laws restrict the measure of time a money order is good for. Notwithstanding, the organization that gives the money order may force money order limits on how long It can use it. For instance, Fidelity Express charges a service expense if a client liquidates a money order over two years old. If the issuer gives a month-to-month service charge for every month past the deadline, the money order probably will not merit anything after a specific timeframe.

Below is a list of significant issuers and their policies on how long you have before a money order expires.

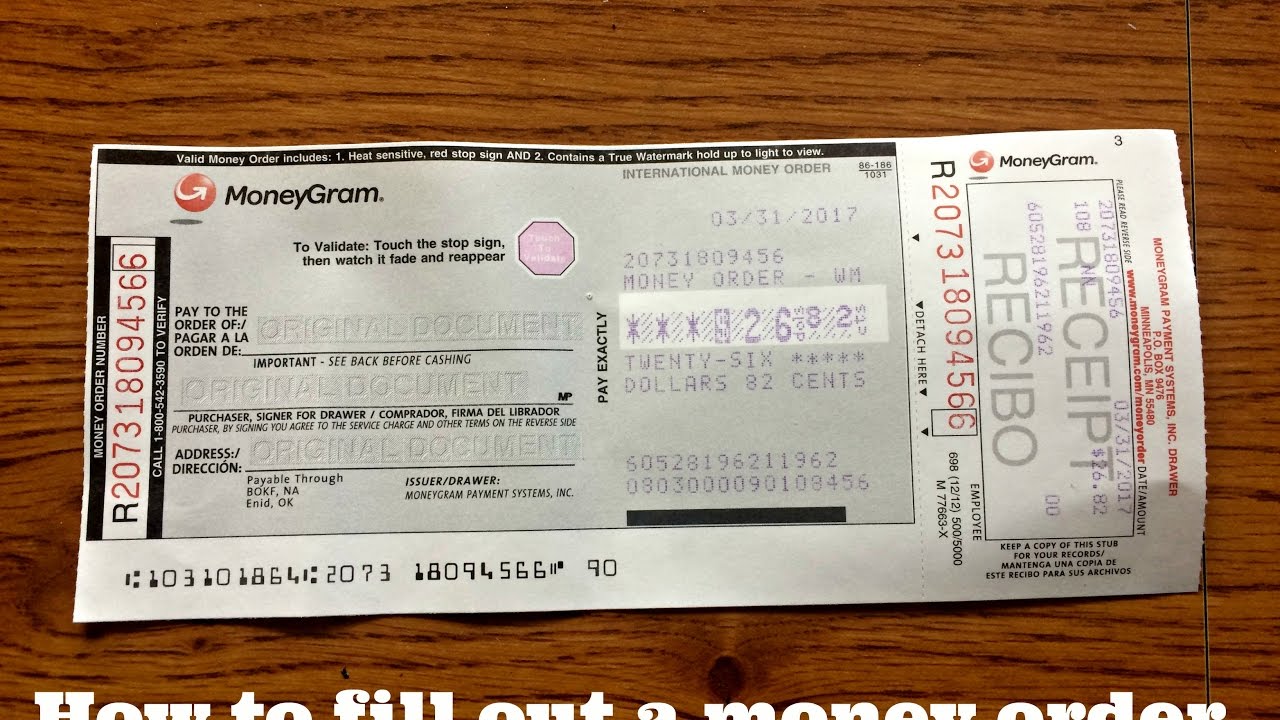

MoneyGram

Image Source: Youtube

Expires: Never

Depreciation policy: Monthly service charges are taken by MoneyGram once the money order is a year old. The back of your money order displays the amount of the monthly service charges (if in case you have to pay them). The service for money order fees that are accumulated from the face value is deducted by MoneyGram.

Purchase fee: May vary by location

Unpaid service fee: Listed on the back of the money order; kicks in after one year.

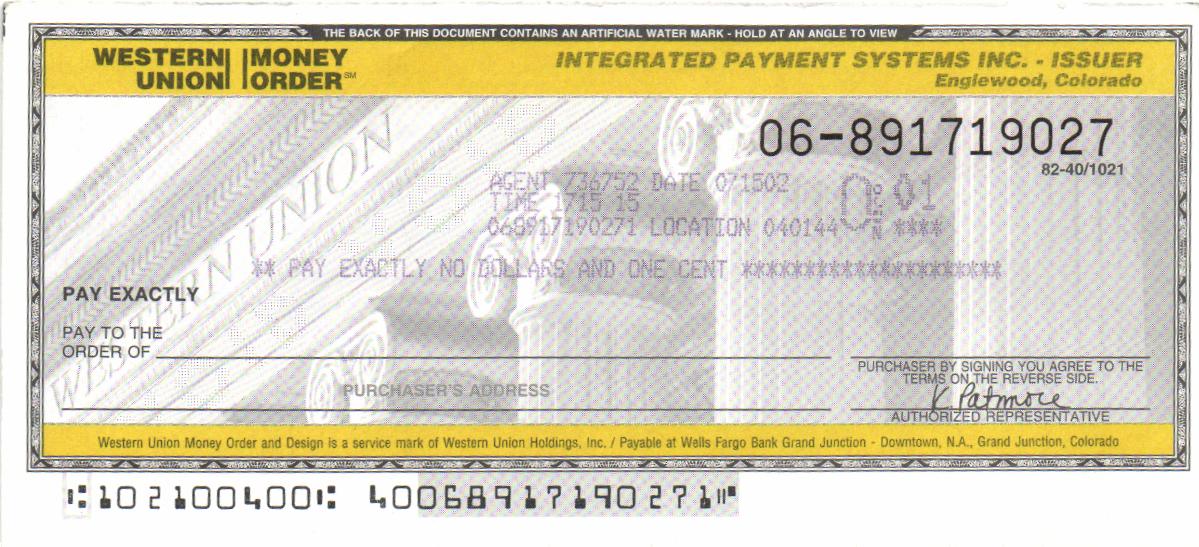

Western Union

Image Source: Weltbanknote

Expires: Never

Depreciation policy: In one to three years from the original date of purchase, the cash request will start to deteriorate. The specific service fees will appear on your money order’s back. Instead of changing or keeping the money order, you must demand a refund from Western Union.

Purchase fee: May vary by location

Unpaid service fee: Listed on the back of the money order; kicks in after 1–3 years

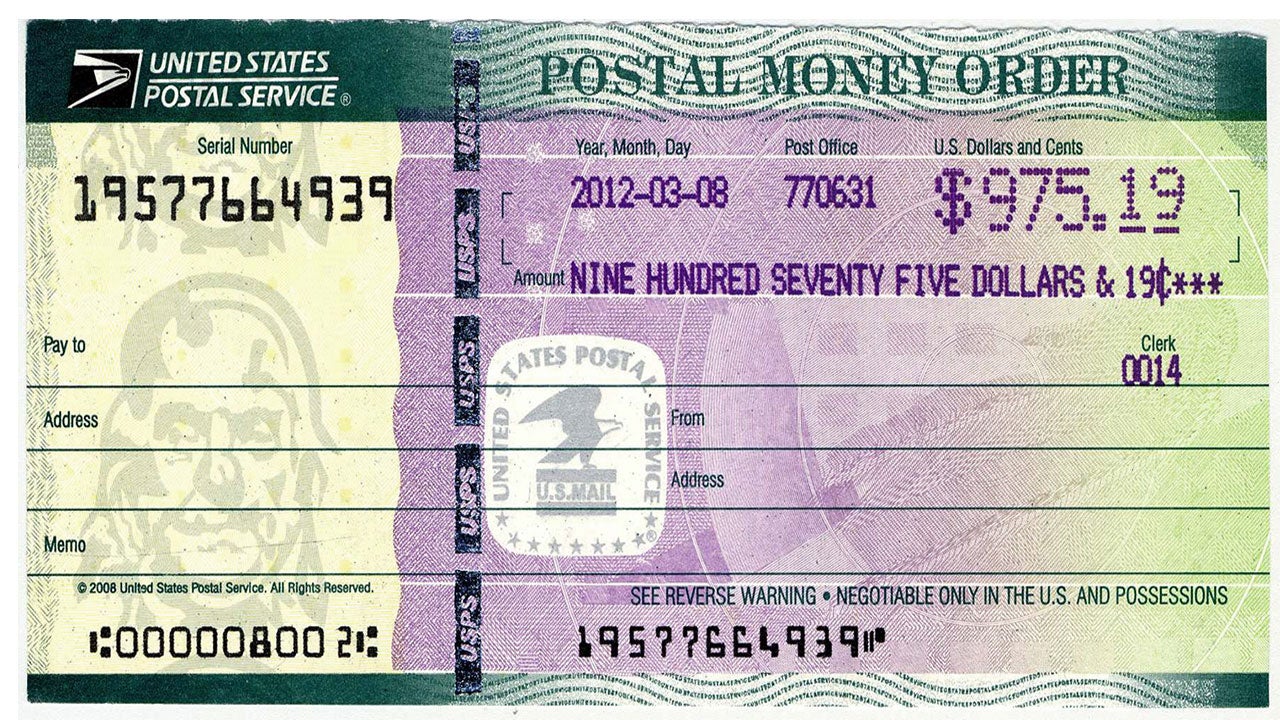

United States Postal Service (USPS)

Image Source: Bankrate

Expires: Never

Depreciation policy: With USPS, there is no depreciation on your money order. Regardless of the purchase date, the issuer will pay the precise total value of the money order you bought.

Purchase fee: Up to $1.75

Unpaid service fee: None

Amscot

Image Source: Annahof-Laab

Expires: Never

Depreciation policy: With Amscot, the money orders decrease in value each month after one year of purchase. A monthly service charge of $2 will be deducted from the face value, with a maximum fee of $144.

Purchase fee: None

Unpaid service fee: $2 per month, up to $144; kicks in after one year

Important Bank Obligations

The Uniform Commercial Code says that banks do not need to cash over half a year-old cheques except if the check is affirmed. In this way, banks have the caution to decline a money order that is over a half-year-old, regardless of whether or not the issuer puts any expiration date on the money order at the hour of issue.

Transmitting money orders

Use money orders as a secure substitute for cash and personal cheques when mailing money. Money orders issued by the U.S. postal service are inexpensive, widely recognized, and never expire. Your money order receipt will assist you in keeping track of your payment and serve as evidence of value if the money order is destroyed, lost, or stolen.

How to send money orders domestically?

- Choose the amount for the money orders. You can send up to $1,000 in a single purchase anywhere in the United States.

- Any post office location will do.

- Consider bringing cash, a debit card, or a traveler’s check. Credit cards are not accepted as payment.

- Together with a salesperson, complete the money order at the counter.

- Pay the money order’s face amount plus the issuing charge.

- For money order tracking purposes, save your receipt.

Domestic money order cashing procedures

Domestic money orders do not earn interest and never expire. The amount specified on the money order is used to cash it. It can freely cash a USPS money order at a post office. Additionally, most banks and certain retailers will cash it. It can freely cash a USPS money order at a post office. Additionally, most banks and certain retailers will cash them. If they have enough cash, rural transporters can make money orders.

Using the post office to cash a money order

- It should not sign money orders.

- Bring the money order and a primary picture ID to any post office location.

- Sign it at the counter in front of a salesperson.

- See the different criteria for money orders made to organizations, multiple people, or minors.

Check a money order’s status

Visit the money order application anytime to check the status of your money order from the U.S. postal service. The following details should be available for the postal money order you wish to verify:

- Postal code

- Serial number

- Monetary value

Replacing money orders that were damaged, stolen, or lost

Stolen or lost money orders

It cannot stop a postal money order from being paid. However, it can replace them if they are lost or stolen.

- The confirmation of a money order theft or loss may take up to 30 days

- It might take up to 60 days to determine whether a money order is misplaced or stolen.

- The cost of replacing a lost or stolen money order is $14.60.

Making a refund request

- Visit any post office with your money order receipt.

- To begin a money order inquiry, speak to a counter-salesperson.

- By accessing the money orders application after commencing the inquiry, you may monitor the status of your money order and the progress of the investigations.

- If it is determined that your money order was lost or stolen, we will send you a replacement.

Defective money order

Money orders that are faulty or damaged will be replaced. Bring the damaged money order, your receipt, and yourself to your neighborhood post office to acquire a replacement.

Scams And Important Warnings

Since money orders are generally safe, identity theft and other fraudulent conduct are rare. But it would be beneficial if you never relax your vigilance. The fictitious buyer scam is the most typical fraud. The fraudster sends you a fake money order to buy goods from you. Unfortunately, when you realize It must verify their payments, they already have your interests. Additionally, you must be careful of overpayment schemes, rental reversals, phony buyer’s remorse, and deposit help.

If somebody gets in touch with you saying that they found an old money order and want to give you a portion of it in return for you cashing it, do not consent to do such a thing. It is a type of advanced-fee scam in which the person doing the fraud offers you “free” cash and afterward constantly requests that you pay charges or different expenses before getting your cash. Likewise, a few scammers request that you cash a money order for a more significant amount of cash than what the scammer owes you and keep the difference. If you succumb to this trick, you may be obligated to your bank for the money order’s total expense or deal with wire fraud indictments.

How to receive money orders and recognize a fake?

Verify a money order is authentic before receiving it. You must closely examine a few essential details to identify a fake money order.

Look over the paper

To deter fraud, genuine USPS money orders bear distinctive symbols and patterns. When you shine a light on the money order, you should be able to see the following:

- Ben Franklin’s watermarks are repeated from top to bottom on the left side.

- A vertical, multicolored thread with the letters “USPS” flows in and out of the paper to the right of the Franklin watermark.

Verify the currency amounts

- If it is discolored, it may have deleted the cash figure, which would indicate fraud.

- Ensure that the amount is written twice

- Check to see whether the amount is too high

- The maximum value of a domestic money order is $1,000

- Money orders sent internationally are limited to $700

Consider a fake?

- Call the U.S. postal inspection service if you think there has been fraud.

- Call the money order verification system if you have received a bogus money order.

Essential bank obligations

Money orders are available via retailers, including Wells Fargo, retail banks, the US postal service, pharmacies, and supermarkets. You must pay both the face amount of the money order and the cost of utilizing funds from your checking or savings account if you buy a money order from a bank. If you are the beneficiary, you may deposit your money order without incurring additional fees into your bank account.

However, you must first sign off on the back. You may occasionally be required to provide your government-issued photo ID and sign the order before a bank staff.

Changes in service fees

The location and value of your money order charge you fees. The US postal service, for instance, charges $1.45 for purchases up to $500 and $1.95 for goods between $500.01 and $1,000. The exact costs at a retail bank might run you up to $5.

How Long Is A Chase Money Order Good For?

Image Source: Geniuz Media

However, Chase sells and cashes money orders with certain limitations. By and large, it just offers money order services to individuals who hold an account. Chase offers money orders of up to $1,000. There is no base sum. You can pay for a Chase moneyorder or debit your financial account.

The company, by and large, will give money orders if you have a bank account with Chase. Nonetheless, a few areas said they would provide moneyorders to non-clients who pay in actual money, while others said they would give money orders to Chase credit card holders.

Typically, for the most part, Chase will cash orders drawn on its bank for only clients. There are no charges or set cutoff points on the sum or number of money orders you can cash as a Chase account holder or restrictions on how long money orders are suitable. However, singular branches may execute limits at their prudence. For non-Chase moneyorders, you can store the assets in your Chase ledger.

There are minimal branches that said that they would cash Chase money orders for non-clients. Wherever this service is accessible, the charges are typical $8. The highest is $1,000 since that is the maximum amount of a Chase money request.

Do Money Orders Have A Purchase Date On Them?

The date of purchase is the date upon which you buy the moneyorder and will be mentioned on the money order. For example, Western Union is among the most common money order issuers. Where is the purchase date on a Western Union money order? Typically, such information is given on the back of the money order.

As far as the expiration date is concerned, it is not stated on the moneyorder. Notwithstanding, contingent on the condition of procurement, if you do not utilize or cash the moneyorder in a matter of one to three years of the date of purchase, a non-refundable assistance fee will be deducted from the principal sum.

The service charge conditions are depicted on the back of the moneyorder. If the money order meets those conditions, a non-refundable service charge will be deducted from the sum on the particular money order.

What Happens When A Money Order Is Not Cashed?

When a money order goes uncashed, you have the option to cancel it through the issuer, such as USPS, Western Union, or MoneyGram. This process typically involves filling out a form or returning it to the place of purchase.

To initiate the cancellation, bring along identification and any relevant information about the money order. It’s especially helpful if you have the original receipt from when you bought the money order, as it contains crucial details like the money order number.

Cancellation can be done either in person or remotely, but paperwork is necessary either way. Keeping your receipt handy streamlines the cancellation process, providing essential information for the issuer to verify and confirm that the money order hasn’t been cashed.

Once you’ve submitted your cancellation request, the issuer will investigate to ensure the money order remains unpaid. Depending on the issuer’s policies, you’ll receive a refund or a replacement if the money order is still outstanding.

The timeframe for this process typically spans 30 to 60 days, although it may vary based on the circumstances. If it has been cashed, you can obtain a copy of the transaction record to determine who endorsed it and when.

In cases involving theft or fraud, these documents can be invaluable for both reclaiming your funds and assisting law enforcement in apprehending the perpetrators. Such evidence may also help rectify situations where the bank failed to properly verify the identity of the individual cashing it.

How to manage uncashed checks from your writing?

You might want to contact the person you sent a check to if you’ve been waiting an unusually long time for them to cash it to be sure the check wasn’t stolen or misplaced. Here are some guidelines for handling unpaid checks. How to manage bounced checks if you are aware of the payee:

- Make contact with the payee to inquire about the check’s status.

- Put a stop payment on the check if it has been stolen or lost, and give the payee another check.

- Verify with the bank that a check older than six months will not be honored.

- On the check, place a stop payment order. It safeguards you if a cashier cashes a check before the expiration date has passed.

- Put enough money in a savings account to cover the value of the check. The check’s payee will eventually demand payment.

How Long Is A Cashier’s Check Good For?

Cashier’s checks are a kind of official check, and the guidelines encompassing them can be convoluted. As far as the question of how long a cashier’s check is good for is concerned, there is no set or indicated expiration date for clerk’s checks. Some state that these checks do not lapse, while others claim that a clerk’s check is old or outdated after 60, 90, or 180 days. The responsible bank supports cashier’s checks and, hypothetically, ought to be legitimate however long the bank is inactivity. However, a few banks will put expiration dates on the checks themselves.

It may be hard to cash a conceivably terminated cashier’s check or to get a substitution cashier’s check. If you get one, search for a “void after X days” disclaimer and ensure your cash or deposit the statement before that point. If you find an old cashier’s check, contact the responsible bank and ask them what they need from you to deal with the transaction.

Pros & Cons

The good news is that you can always cash it out. But the advantages go further than this. Moneyorders are significantly safer than other forms of payment since They can only use them to pay the authorized recipient and conceal personal information. Additionally, you may buy money orders at several places, including your neighborhood post office, bank, pharmacy, grocery store, and retail outlet, to name a few.

For your orders, the majority of retailers charge a few bucks. However, banks and credit unions may demand a higher rate. Moneyorders might not always be your best option. Not now that less expensive and quicker competitors like Zelle and Venmo have entered the market. You can track them to know when one is cashed.

Additionally, they are safer than cash because they are frequently made out to a specific individual so that only they may cash the moneyorder. Additionally, you may receive one without having a bank account, and the money is guaranteed. However, the face amount has a cap and must be bought in person. If you use a lot of money orders, even small costs might build up over time.

Alternates

Consider some options to avoid the possible drawbacks of a moneyorder, such as late penalties for not cashing it promptly.

Peer-to-peer payment app

If the person you are transferring money to has an account with PayPal, Venmo, Zelle, Cash App, or another peer-to-peer payment app, you should transmit the funds electronically. However, if your recipient doesn’t have an app or you’re transferring money to a business, this choice might not be viable.

Cashier’s check

Because it is a prepared financial document, a cashier’s check is comparable to a moneyorder. The distinction is that a bank gives a cashier’s check, so getting one might require you to have a bank account. Additionally, they cost a little bit more. Cashier’s checks, however, are preferable for more significant purchases because they can have much higher limits than money orders.

Wire transfer

You should use this method if you’re transferring money overseas. It usually costs more, but it can transfer funds to the receiver faster than mailing a money order.

Money transfers are just one of the many funding options available to you. It helps to be aware of all your choices before deciding how to make a payment, as with any other financial choice.

FAQ’s

How much is a moneyorder cost?

How much is a money order? The cost of a money order depends on the provider but typically ranges from $0.70 to $10.00. Some providers may offer lower rates for larger money orders. For example, Western Union charges a flat fee of $5.00 for moneyorders up to $1,000.

Where can I get a money order?

There are a few places where to get a moneyorder. You can purchase one at a post office, grocery store, or convenience store. You will need to fill out the form and pay with cash, and then It will mail the money order to the recipient.

How is a money order cashed?

Banks, credit unions, supermarkets, and other businesses frequently taking checks also pay out money orders. The money order needs to be signed, you must present your ID, and there is a minor charge.

Can you get a money order refunded?

Here is how to request a refund if you have the buyer’s paperwork and your moneyorder hasn’t been paid yet:

- It must complete the “money order refund request” document.

- Please present your ticket.

- Click the “submit” option after agreeing to the terms and conditions.

Can you pay a mail money order from the past?

Briefly, sure. But how long is local currency valid? They are perpetual and do not grow older. You can always pay your order’s sum through the US postal service.

Conclusion

When purchasing a money order, you pay the cash upfront along with a small fee. This means you can’t cancel it like you would a check, and your recourse is limited if the recipient fails to provide goods or services. Additionally, if stolen and cashed, recovering your money or obtaining a replacement may prove more challenging compared to a stolen check. Furthermore, they have no expiration date, though their value may diminish if left uncashed for an extended period, typically two to three years.