Unlock hassle-free transactions: Learn how to fill out a MoneyGram money order with confidence! Simplify your financial moves and avoid errors with our step-by-step guide. Your stress-free transactions start here.

Finances can be tricky to navigate, but don’t worry – we’ve got your back when filling out a MoneyGram money order. Understanding the process can save you from potential issues whether you’re a pro or new to the game.

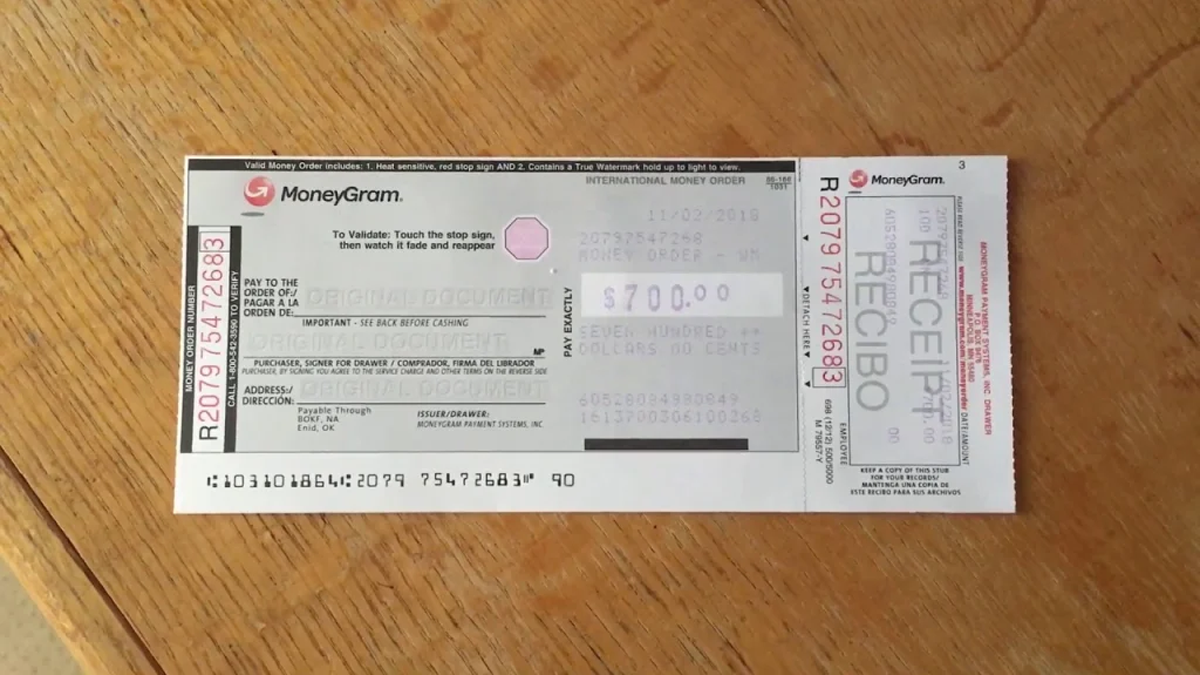

So, you’ve got this official-looking piece of paper – a MoneyGram money order. But how do you fill it out? This guide has your back, walking you through each step so you can confidently provide the needed details.

MoneyGram money orders are more than paper – they’re your ticket to secure financial transactions. With a unique tracking number and online monitoring, you’re in control. No more guessing – you’ll know when your money order is cashed.

Why stick to traditional banking when MoneyGram money orders offer a flexible solution? Whether personal or business transactions, these money orders are widely accepted, giving you a practical and accessible option.

Efficiency is key. Knowing how to fill out a MoneyGram money order correctly streamlines everything. We’ll guide you through the details, highlight the importance of info like the recipient’s address, and share tips for a smooth transaction.

Ready to dive into the world of MoneyGram money orders? Could you stick with us? By the end of this guide, you’ll confidently handle filling out a MoneyGram money order, armed with the knowledge to breeze through your financial transactions.

How to fill out a MoneyGram money order?

Money orders are a secure and reliable way to make payments or send funds. If you’re new to using MoneyGram money orders, don’t worry—it’s a straightforward process. Here’s a step-by-step guide on correctly filling out a MoneyGram money order.

Start with the payee information

Begin by writing the name of the person or business you’re paying. It is crucial as it ensures the funds go to the right recipient. Double-check the spelling and accuracy of the payee’s name to avoid any complications.

Include your information

On the “Purchaser” or “from” line, write your full name and address. It helps identify you as the sender. Providing accurate information is essential for tracking and verifying the transaction.

Specify the payment amount

Write the amount you are paying in the designated box. Use numerals and write the amount as close to the left edge as possible to prevent alterations.

Utilize the memo line (if needed)

Use the memo line if you’re paying for a specific purpose, such as rent or a bill. Write a brief note indicating the reason for the payment. This extra step can help you and the recipient keep track of the transaction.

Sign the money order

Remember to sign your money order. Your signature is crucial for the transaction’s validity. Sign it exactly as your name appears on the front of the money order to avoid any issues.

Detach the receipt stub

Carefully tear off the receipt stub along the perforated edge. This portion contains essential information, including the money order’s serial number. Keep the stub for your records as proof of payment.

Verify the details

Before sending or handing over the money order, review all the details. Confirm the accuracy of the payee’s name, the payment amount, and your information. This quick check can prevent potential errors or delays.

In conclusion, filling out a MoneyGram money order is a simple process that provides accurate information about the payee, yourself, and the payment amount. Remember to sign the money order, detach the receipt stub, and double-check all details for a smooth and secure transaction. Now that you know how to fill out a MoneyGram money order, you can confidently use this payment method for various transactions.

Steps to fill a MoneyGram money order

If you’re holding a MoneyGram money order and wondering how to fill it out, don’t worry—it’s a straightforward process. Follow these steps to ensure your transaction goes smoothly.

In today’s digital age, understanding how to fill out a MoneyGram money order is valuable for anyone navigating financial transactions. Whether sending money to a friend or making a payment, this step-by-step guide will ensure a smooth process.

Gather your information

Before filling out the MoneyGram money order, ensure you have all the details. You’ll need the recipient’s full name and address. Double-check the spelling and accuracy of this information to avoid any issues later on.

Visit a convenient location

Find a nearby MoneyGram location. These can be found in various places, including grocery stores, pharmacies, and check-cashing outlets. Confirm their business hours so you can complete the transaction at your convenience.

Bring sufficient funds

Ensure you have enough cash to cover the total amount of the money order, including any associated fees. MoneyGram may charge a fee for their services, so be aware of this and factor it into your total.

Fill out the money order

Take a pen and begin filling out the money order. Write the recipient’s name and address in the designated spaces. Be meticulous and avoid any errors, as mistakes may lead to complications.

Add your information

Include your name and address in the purchaser information section. This step is crucial for record-keeping and tracking purposes. It also ensures that the transaction is linked to you.

Sign the money order

Put your signature on the front of the money order where indicated. It adds an extra layer of security and confirms that you are initiating the transaction.

Detach and retain the receipt

Carefully tear off the receipt portion of the money order. It serves as your proof of payment. Keep it safe until the transaction is complete and you can confirm that the recipient received the funds.

Track your MoneyGram money order

For added peace of mind, use the tracking number on your receipt to monitor the status of your money order. It ensures you can trace the transaction and verify its successful delivery.

Now that you know the steps to fill out a MoneyGram money order, you can confidently handle your financial transactions. Whether you’re sending money for personal or business reasons, following these steps ensures a smooth and secure process.

How to fill out a MoneyGram money order is a common question, and the answer lies in a few simple steps that we’ll walk you through.

What is a money order?

A money order is a safe and Super-accepted payment, an excellent alternative to personal checks or cash. If this money tool is new to you, no worries—I’ll explain what it is and how it can be your financial sidekick.

Firstly, locate a MoneyGram location near you and pick up a money order form. Knowing how to fill out a MoneyGram money order begins with providing accurate information about the sender and recipient.

Getting the lowdown on money orders

Picture this: A money order is like a piece of paper that looks like a check. Banks or money places dish it out, and it’s your way of saying, “Hey, I’ve got this cash ready to roll.” It’s way safer than carrying loads of money. You can grab one at banks, post offices, or regular stores.

The money order dance

So, you’re getting one. You say who gets the money and how much. Boom, the money order becomes a promise of payment because the cash is already prepaid. It’s a top pick when someone’s not keen on taking your checks or cash.

Dropping a money order into the mix adds a layer of safety, lowering the chance of someone swiping it or pulling a fast one. Once you fill in the info, it turns into a magic paper that only the person you named can cash.

The perks of money orders

Here’s a cool thing about using a money order—it’s like a detective. Each one has its secret code (okay, it’s a tracking number). You can peek at it and see if your money order has hit the cash jackpot.

Money orders are the go-to when online payments aren’t the vibe. Whether buying something or sending cash to a friend without a bank, a money order is like your trusty sidekick, always ready for action.

When to money order?

Think about whipping out a money order when you’re after a payment method that screams “safe and sound.” It’s fantastic for deals with more considerable money or when someone on the other end needs a guarantee. People toss money orders into the ring for rent, buy from folks or businesses, and sell money to family or pals.

In a nutshell, a money order is your slick and safe money move. Now that you’re in the loop on what it is and how it does its thing, you’re all set to make it rain with money orders in your financial adventures.

In the “Purchaser, Signer for Drawer” section, your signature is required. Understanding how to fill out a MoneyGram money order involves adhering to security measures.

How to send a money order?

Sending a money order is a breeze, ensuring your funds get where they need to go safe and sound. Let’s get into the steps for sending a money order without drama.

Double-check recipient details

Before hitting send, ensure you have the recipient’s name and address. Accuracy is critical to ensure your money ends up in the right hands.

Choose a trusty service

Go for a reliable service like MoneyGram—it’s like the superhero of money sending. They’re everywhere, making sure your funds travel securely. Check their spots and hours to find a convenient location for you.

Grab the money order

It’s time to get that money order. Pick the amount you want to send, add any fees, and follow the steps in the “how to fill out a MoneyGram money order” guide. It’s like filling out a form but with cash involved.

Wrap it up safely

Don’t just toss that money order in an envelope; give it some protection. A solid envelope or a padded package will keep your money order safe during its journey.

Pick a safe delivery ride

Choose a delivery method that’s safe and trackable. Some services offer excellent options, like certified mail or express delivery. Pick one that lets you follow your money order’s adventure until it reaches its final destination.

Keep hold of that receipt

That little piece of paper with the tracking number? Keep it close. It’s proof that you sent the money and your lifeline in case anything goes wonky or if you want to check where your money is.

Give the heads up

Once you hit send, drop a message to the person getting the money. Share the tracking number and any necessary information to grab the funds. Keeping everyone in the loop is the name of the game.

Keep an eye on it

Use that tracking number on your receipt to stay in the know. Check online regularly to make sure your money order has safely landed. It’s like the cherry on top, adding an extra layer of confidence to the whole process.

You’re confidently in the driver’s seat by following these steps and sending that money order. These tips ensure your money travels smoothly, giving you peace of mind—whether for business or just helping out a friend.

The next step in our guide on how to fill out a MoneyGram money order involves tearing off the receipt portion at the perforated line. This serves as your proof of payment.

Advantages and disadvantages of money orders

When handling your money, knowing the good and not-so-good sides of using money orders helps you decide smartly. Let’s dive into what’s cool and not about money orders so you can make the right choices.

Now, proceed to the MoneyGram counter and hand over your completed money order form and the required funds. Understanding how to fill out a MoneyGram money order also involves selecting a convenient payment method.

Pros of money orders

1. Security and tracking:

Money orders are like the superheroes of secure money-sending. Each has its unique tracking number, so you can watch it travel and know when it’s reached its destination. This extra security is a win for both the sender and the receiver.

2. No bank account? No problem:

A big plus is that you can use money orders even if you or the person getting the money doesn’t have a bank account. It makes them handy, especially when dealing with folks or businesses wanting guaranteed funds.

3. Easy to get anywhere:

Money orders are like the friendly neighbors you can find anywhere. You can snag them at banks, post offices, and other spots. It makes them a piece of cake for folks needing easy access to regular banking.

Cons of money orders

1. Fees, fees, fees:

Here’s the not-so-cool part—fees. Money orders might be convenient, but they often come with prices that can sneak up, especially for more significant amounts. Remember to count these costs when deciding if a money order is your go-to move.

2. Limits on cash flow:

Money orders usually have a cap on how much cash you can send. If you’re throwing around a hefty sum, get ready to buy multiple money orders, and yes, that means more fees.

3. Watch out for loss or theft:

Money orders can pull a Houdini and vanish or get swiped like anything physical. They’re traceable, but it’s a good idea to keep your receipt and tracking number safe just in case something goes wonky.

Making smart choices

Knowing the ups and downs of money orders puts you in the driver’s seat. Whether you’re sliding cash for personal or business reasons, weighing these pros and cons helps you pick the method that fits your style.

And hey, remember the golden rule: follow the steps, like how to fill out a MoneyGram money order, to get the most out of the good stuff and dodge the not-so-good bits that come with this money tool.

How does a money order work?

Have you ever wondered how those money-order things operate? Let’s break it down so you can confidently handle your transactions without head-scratching.

Purchasing a money order

Getting started:

So, are you ready to send some money? Easy peasy. Head to banks, post offices, or retail spots to order money. Simple enough? Tell them who’s getting the cash and how much you’re sending.

Filling in the details:

Now comes the paperwork, but don’t worry; it’s not rocket science. Follow the “how to fill out a MoneyGram money order” guide. Add your details, the recipient’s info, and the amount. Boom, it’s set for its payment adventure.

Prepayment for security

Guaranteeing funds:

What sets money orders apart? Prepayment magic. When you get one, you pay upfront for the amount you want to send. It’s like a safety net, ensuring you and the one getting the money feel secure about the deal.

Preferred by many:

Why do people love this? Picture this: You’re making a deal, and the other party isn’t keen on checks or cash. Enter the money order, the superhero of guaranteed payment.

Traceability for peace of mind

Unique tracking number:

Every money order gets its unique tracking number. This number is your VIP pass to traceability. Keep an eye on its status, and you’ll know exactly when the recipient gets their hands on the cash.

Peace of mind:

Are you worried about your money order getting lost or pulled into shady business? No stress. This traceability feature is your security blanket, minimizing the risk of loss or fraud. Sleep easy, knowing you’re in the know.

Accessible and widely accepted

No bank account needed:

Here’s the cool part – no need for a bank account. Anyone can send or receive a money order. It’s like the Swiss Army knife of payments, fitting into situations where traditional banking might not.

Versatility matters:

Money orders serve as the ultimate multitool in your financial arsenal, seamlessly navigating personal and business transactions alike. Their widespread acceptance and accessibility make them indispensable in today’s fast-paced world.

Mastering the intricacies of money orders empowers you to take control of your finances. It’s a reliable and secure method for transferring funds, streamlining various transactions effortlessly. By familiarizing yourself with the process, particularly how to complete a MoneyGram money order, you harness the full potential of this invaluable financial resource.

How do you pay with a money order?

Navigating the payment process with a money order is a breeze, offering a secure alternative to traditional methods. Let’s explore the steps to smoothly pay with a money order and make your transactions stress-free.

Obtaining a money order

First things first:

To start, you need a money order. Head to your local bank, post office, or retail spot that offers these services. Specify the recipient and the amount you want to send.

Filling it out:

Now, here’s the crucial step: filling out the money order. Refer to the “how to fill out a MoneyGram money order” guide for specifics. Ensure you include your details, the recipient’s information, and the correct amount.

Handing over the money order

Choose the right place:

Pick a location that accepts money orders. Many businesses, service providers, and individuals are open to this form of payment. Confirm with the recipient that they can receive money orders.

Hand it over:

When you’re ready to pay, handing over the money order to the recipient is like passing over a secure, prepaid piece of financial magic.

Confirming receipt

Keep that receipt handy:

Hold onto the receipt that comes with the money order. It contains a unique tracking number. This number is your ticket to confirm that the recipient has received and cashed the money order.

Tracking the progress:

Use the tracking number to monitor the status online. It gives you peace of mind, ensuring your payment has reached its destination successfully.

Considerations for business transactions

Verify acceptance:

Before completing a business transaction with a money order, ensure that the recipient accepts this form of payment. Some businesses may have specific preferences or restrictions.

Communicate transparently:

When paying for business services or products, communicate clearly with the recipient. Provide them with the tracking number and any additional information they may need for a smooth transaction.

Paying with a money order is straightforward, providing a secure option for your financial transactions. Following these steps, you can confidently use money orders for personal or business payments, ensuring a smooth and reliable payment experience. And remember, understanding how to correctly fill out a MoneyGram money order ensures that your payment journey remains hassle-free.

Knowing how to fill out a MoneyGram money order is empowering, offering you a reliable and accessible means of transferring funds.

What information is needed for a money order?

Knowing what to jot down when getting a money order ensures a hassle-free and secure transaction. Let’s break down the essentials to fill out a money order correctly.

In conclusion, mastering how to fill out a MoneyGram money order is a straightforward process that enhances your financial capabilities. Follow these steps, and you’ll navigate money transfers with confidence and ease.

Your info

The basics:

First off, it’s all about you. The money order will ask for your full name and, sometimes, your address. It is so they have your deets on record, you know, in case they need to trace you.

Your place:

Some money orders might want your address, too. It adds more clarity, ensuring everyone knows where the money comes from.

Recipient’s details

Full recipient name:

Precision matters when you’re giving the recipient’s info. Write their full name with crystal-clear accuracy. This step is crucial to ensure the money is in the right hands.

Where they at:

If you can swing it, throw in the recipient’s address. It’s an excellent detail for confirmation and adds an extra layer of security to the whole deal.

Amount talk

Exact amount:

No room for guessing here. Clearly state the precise amount you’re sending. It avoids any confusion and ensures the receiver gets precisely what you intended.

Currency chat:

Some money orders might want to know the currency. Remember to mention it to dodge any potential hiccups during the process.

Extra pointers

Stick to the rules:

Always stick to the guidelines given by the money order folks. Different services might have quirks, so paying attention to the deets is crucial.

Check twice before dishing out cash:

Before sealing the deal, give everything a once-over. Accuracy is critical; catching any slip-ups early can save you from headaches for payment.

Giving the correct info when filling out a money order is the ticket to a successful transaction. Remember your details, the recipient’s information, and the exact amount. Stick to the guidelines, double-check, and you’re ready for a smooth money order journey. And hey, knowing how to fill out a MoneyGram money order makes the whole process a breeze.

FAQ: How to fill out a MoneyGram money order?

What do I need to fill out a MoneyGram money order?

Just your basics! Please give them your full name and sometimes your address. And for the person getting the money, be spot-on with their name and, if you can, their address too. Remember to mention exactly how much you’re sending and, if they ask, the type of currency.

Why should I add the recipient’s address?

Adding their address adds more security. It’s like an extra layer to ensure your money lands where it should. It avoids any mix-ups and makes the whole transaction safer.

Can I grab a MoneyGram money order without a bank account?

Totally! That’s the beauty of it. There is no need for a bank account—whether you’re sending or receiving. It’s handy, especially if you or others aren’t big on traditional banking.

How do I keep tabs on my MoneyGram money order?

Easy. They give each money order a unique tracking number. Use that to check online and see when the recipient cashes it. It keeps things secure, so you know your money’s in good hands.

Any extra tips for a smooth money order game?

You bet. Stick to the money order folks’ rules, and double-check everything before sealing the deal. Mistakes can trip you up, so catching them early is better. Knowing how to correctly fill out a MoneyGram money order by following the steps is your shortcut to a smooth ride.

Can I throw a MoneyGram money order into my business moves?

Absolutely. They’re like the Swiss Army knife of payments—accepted all over. Just check if the other party is excellent with money orders and share any extra info they might need. Keeps the business flowin’ without a hitch.

As financial landscapes evolve, equipping yourself with practical knowledge on topics like how to fill out a MoneyGram money order becomes increasingly important. Stay informed, stay empowered.