Warren Buffett can be regarded as a true self made man. Starting from an early age when children are playing with toys, he made his way to the top. Continue reading to learn more about him.

In finance and investing, few names carry the same weight and respect as Warren Buffets’. His extraordinary success as an investor and timeless wisdom have made him an icon in the industry. Warren Buffett can be regarded as a true self-made man. From an early age, he went to the top when children were playing with toys. But amidst all the admiration and awe, many people wonder: How old is Warren Buffet?

This article will examine his captivating journey through the years to unravel the secrets behind Warren Buffett’s enduring brilliance. We’ll look at his formative experiences and milestones that have shaped his exceptional career. From his early ventures as a young investor to the establishment of Berkshire Hathaway and his steadfast commitment to value investing, we navigate the chapters of Buffett’s life that have paved the way for his iconic status.

Moreover, we will examine how Buffett’s age has influenced his investment strategies, decision-making processes, and overall investment philosophy. By understanding the interplay between time and wisdom, we gain insights into the principles that have propelled Buffett to become one of the most successful investors of our time.

How old is Warren Buffett?

Born on August 30, 1930, Buffett has entered his 92nd year of life as we reach June 2023. His longevity is a testament to his vitality and enduring impact on the world. With nearly a century of experience and knowledge, Buffett’s age reminds him of the wisdom and insights he has gained throughout his remarkable career. His age only adds to his name’s awe and reverence as he continues to inspire and guide individuals in finance, leadership, and philanthropy.

Warren Buffett biography?

Warren Buffett, born on August 30, 1930, is an American business investor, magnate, and philanthropist. He is widely regarded as one of the most successful investors in history. Buffett is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company based in Omaha, Nebraska.

| Net worth | $110 Billion |

| Age | 92 years |

| Born | August 30, 1930 |

| Gender | Male |

| Height | 1.78 m (5 ft 10 in) |

| Country of origin | United States of America |

| Source of wealth | Entrepreneur/Investor |

Early Life and Education

Warren Buffett, showed an early aptitude for business and investing. As a child, he bought Coca-Cola bottles from his grandfather’s store and sold them at a profit. He also sold gum and magazines and worked odd jobs to make money. Buffett’s interest in the stock market began at a young age, and he started studying financial statements and analyzing businesses.

Buffett completed his education at the University of Pennsylvania and later attended Columbia Business School. On his first tax return in 1944, he took a $35 deduction for using his bicycle on his paper route. In 1945, he and a friend bought a used pinball machine and started a small business, which they sold for $1,200 later that year.

Image Source: 13angle

Buffett’s investment journey continued, and at age 11, he bought three shares of Cities Service Preferred for himself and his sister. By the time he finished school, he had accumulated $9,800 in savings. In 1947, Buffett enrolled in the Wharton School of the University of Pennsylvania and later moved to the University of Nebraska, where he graduated with a Bachelor of Science in Business Administration.

After being rejected by Harvard Business School, Buffett attended Columbia Business School and earned a Master of Science in Economics in 1951. He then went on to study at the New York Institute of Finance.

Investment career

After completing his education, Warren Buffett embarked on a successful investment career. In 1956 he partnered with seven other investors and started Buffett Partnership Ltd. This partnership allowed him to invest in stocks and securities, and Buffett quickly gained a reputation for his exceptional investment skills.

Over the years, Buffett consistently outperformed the market, achieving impressive returns for his partners. His investment philosophy, often described as value investing, focused on identifying undervalued companies with strong fundamentals and long-term growth prospects. Buffett’s patient and disciplined approach, coupled with thorough research and understanding of businesses, became the hallmark of his investment strategy.

Business Success and Leadership

One of the defining moments in Warren Buffett’s career was the acquisition of Berkshire Hathaway, a struggling textile manufacturing company, in 1965. Despite the challenges faced by the textile industry, Buffett saw potential in the company. Over time, he transformed Berkshire Hathaway into a diversified conglomerate interested in insurance, energy, manufacturing, retail, and more.

Image Source: Harvard Business Review

Under Buffett’s leadership, the company’s stock price soared, and Berkshire Hathaway became one of the world’s most valuable and respected companies. Buffett’s ability to identify promising businesses and make strategic investment decisions significantly impacted the company’s success. His long-term focus and decision-making cemented his reputation as one of the most successful investors in history.

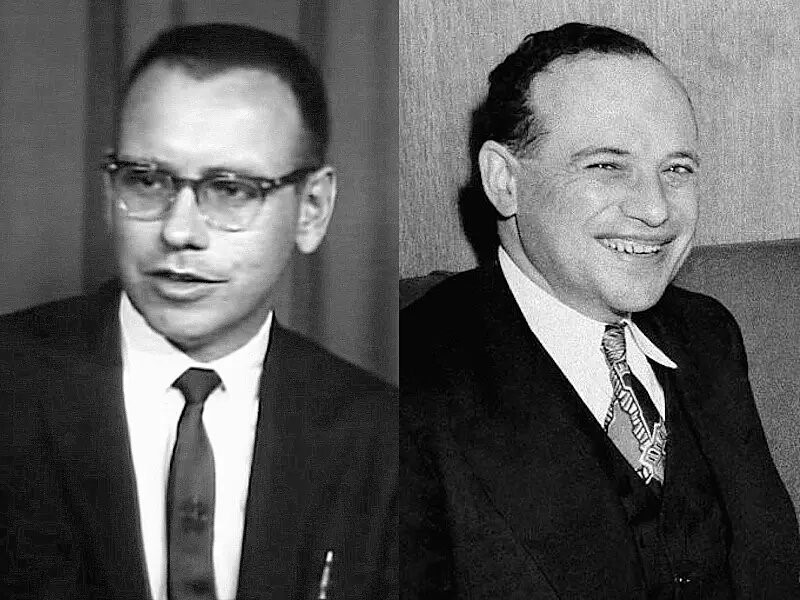

Mentor Ben Graham

Warren Buffett’s relationship with Benjamin Graham, the “father of value investing,” greatly influenced his investment philosophy. Graham, Buffett’s mentor, played a significant role in shaping his approach to investing. Buffett first encountered Graham’s teachings at Columbia Business School and considered Graham’s book “The Intelligent Investor” as the best book on investing ever written. Inspired by Graham’s principles, Buffett aimed to emulate his disciplined and value-oriented approach.

Image Source: Business Insider

Buffett joined Graham’s investment firm, Graham-Newman Corporation, where he learned essential skills in financial analysis and identifying undervalued stocks. Graham’s emphasis on buying stocks at a discount to their intrinsic value and his concept of “Mr. Market” deeply impacted Buffett’s investment philosophy. While Buffett developed his unique style over time, blending Graham’s principles with his own insights, he credits Graham as one of his most important teachers.

Buffett retained the core principles of value investing, focusing on understanding businesses and investing for the long term. Graham’s teachings laid the foundation for Buffett’s success as an investor and his ability to compound wealth over several decades. Graham’s influence continues to shape Buffett’s investment decisions and has left a lasting impact on finance.

Working for Ben Graham

Buffett and Susie moved to a New York suburb, where Buffett focused on analyzing S&P reports for investment opportunities. Differences in thinking between Buffett and Graham emerged: Graham prioritized numbers, while Buffett emphasized company management. From 1950 to 1956, Buffett grew his cash flow from $9,800 to $140,000. On May 1, 1956, Buffett formed Buffett Associates, Ltd. with seven partners, raising $105,000. Over the next five years, Buffett’s investments generated a remarkable 251.0% profit compared to the Dow’s 74.3%. By 1962, his company had over $7.2 million in capital, with Buffett’s stake at $1 million. In 1962, Charlie Munger joined Buffett, solidifying a partnership that lasted 40 years. The Buffett Partnership assets grew over 1,156% in ten years, reaching $44 million. Buffett closed the partnership in 1969 due to market conditions and sold the company, except for Berkshire Hathaway. Buffett distributed Berkshire shares to partners, retaining a 29% stake.

Returning Home

Upon returning home, he took a position at his dad’s brokerage house and started seeing a young lady named Susie Thompson. The relationship ultimately turned serious, and in April 1952, the two were hitched. They leased a three-bedroom condo for $65 per month; it was run-down, and the young couple shared the space with a family of mice. It was here their daughter, also named Susie, was conceived. They made a bed for her in the dresser drawer to save some cash.

Image Source: Insider

During these underlying years, Buffett’s speculations were predominantly restricted to a Texaco station and some land, yet were they effective? He also started encouraging night classes at the University of Omaha. At that point, Graham called one day, welcoming the youthful stockbroker to come to work for him. Buffett was at last given the chance he had hotly anticipated.

Gaining Control of Berkshire Hathaway

Buffett became the chief of Berkshire Hathaway in 1965 after acquiring 49% of the common stock. He appointed Ken Chace president and cosigned an $18,000 loan for Chace to buy company stock. In 1967 Buffett bought the entire National Indemnity company for $8.6 million.

Image Source: TheStreet

In 1970, Buffett became Chairman of the Board and began transforming Berkshire Hathaway. He acquired See’s Candy for $25 million, the largest investment. By 1975, Berkshire’s book value had risen from $20 to $95 per share. Buffett’s ownership in Berkshire exceeded 43%, making it his sole investment. In 1976, Buffett got involved with GEICO, capitalizing on the company’s turnaround and eventually making it a fully-owned subsidiary of Berkshire.

Philanthropy and giving

Image Source: CNBC

Warren Buffet is known for his investment prowess and his commitment to philanthropy. In 2006, he pledged to donate most of his wealth to charity through the Bill & Melinda Gates Foundation and other organizations. His generous contributions have supported various causes, including education, poverty alleviation, and healthcare. Buffett’s partnership with the Gates Foundation has aimed to address global challenges and positively impact society. Beyond his financial donations, Buffett has encouraged other wealthy individuals to follow suit and give back to their communities. His philanthropic endeavors have left a lasting impact and set an example for others to use their wealth to improve society.

Personal life and traits

Despite his immense wealth, Warren Buffett is known for his down-to-earth personality and frugal lifestyle. He lives in the same house he bought in 1958 and maintains a simple routine. One notable aspect of his daily life is his fondness for a McDonald’s breakfast, which he enjoys regularly. Buffett values long-term relationships and loyalty, evident in his close ties with his late wife, Susan Buffett, and his commitment to mentoring and influencing other investors and business leaders. His traits, combined with his exceptional investment understanding, have made him an iconic figure in finance.

Legacy and Influence

Warren Buffet’s life and career have left an indelible mark on the financial industry and beyond. His investment success, philanthropy, and humble demeanor have earned him the nickname “Oracle of Omaha” He consistently ranks among the wealthiest individuals in the world, and his investment insights continue to inspire investors and entrepreneurs globally. Buffett’s enduring legacy lies not only in his financial achievements but also in his influence on responsible wealth management and giving back.

Warren Buffett’s investing philosophy has shaped how many investors approach the stock market. His emphasis on long-term thinking, thorough research, and disciplined decision-making has become a guiding principle for aspiring investors. Moreover, his commitment to philanthropy and his call to fellow billionaires to contribute to society has sparked conversations about wealth redistribution and the social responsibilities of the ultra-rich.

Image Source: Inc42

Warren Buffett’s impact extends beyond the financial realm. He has symbolized integrity, wisdom, and humility in business and philanthropy. His ability to maintain a simple lifestyle despite his wealth and dedication to using his resources to address global issues have inspired others to reassess their priorities and actions. Buffett’s life and career continue to be studied and admired by individuals from various walks of life, and his lessons on investing, leadership, and philanthropy remain valuable for generations to come.

Warren Buffett’s biography encompasses a remarkable journey from a young investor with a passion for business to one of the most renowned and influential figures in the financial world. Buffett has left an indelible legacy through his successful investment career, the leadership of Berkshire Hathaway, commitment to philanthropy, and embodiment of personal values. His story inspires individuals aspiring to achieve financial success, make a positive impact, and lead a life of integrity.

How did Warren Buffett get rich?

In 1962, Buffett saw a chance to put resources into a New England textile organization called Berkshire Hathaway and got a portion of its stock. Buffett started to forcefully purchase shares after a question with its administration persuaded him that the organization required a change in leadership. Ironically, the acquisition of Berkshire Hathaway is one of Buffett’s major regrets.

As a value investor, Buffett is such a handyman with regard to industry information. Berkshire Hathaway is an extraordinary model. Buffett saw an organization that was cheap and bought it, paying little heed to the fact that he was not an expert in manufacturing textiles. Bit by bit, Buffett moved Berkshire’s focus away from its customary undertakings, utilizing it as a holding organization to put resources into different organizations. Throughout the long term, Buffett has purchased, held, and sold organizations in a wide range of ventures.

Image Source: Cooper Academy

Some of Berkshire Hathaway’s most notable auxiliaries incorporate, however, are not restricted to GEICO (indeed, that little Gecko has a place with Warren Buffett), Dairy Queen, NetJets, Benjamin Moore and Co., and Fruit of the Loom. Again, these are just a small bunch of organizations to which Berkshire Hathaway has a dominant share, and Buffett decided to contribute.

The company also has interests in various other companies and businesses, including American Express Co. (AXP), Costco Wholesale Corp. (COST), DirectTV (DTV), General Electric Co. (GE), General Motors Co. (GM), Coca-Cola Co. (KO), International Business Machines Corp. (IBM), Wal-Mart Stores Inc. (WMT), Proctor & Gamble Co. (PG), and Wells Fargo & Co. (WFC).

How much money did Warren Buffett start with?

In the wake of working for the speculation firm of his coach, Graham, for a very long time in New York, Buffett returned to Omaha and began his own venture organization called Buffett Partnership. Buffett started the organization with $100 of his cash and generally $105,000 from seven contributing accomplices who incorporated his sister, Doris, his Aunt Alice, and his father-in-law. Warren Buffett purchased his first Berkshire Hathaway shares for $7.50 each 55 years ago. Berkshire Hathaway’s stock hit a $1,000 per share achievement in 1983 after Buffett spent the 1970s making a line of effective interests in stocks, for example, the Washington Post Company, GEICO, ABC Broadcasting, and RJ Reynolds. Buffett also appeared in the debut issue of the Forbes 400, with expected total assets of $250 million. By 1983, that number had leaped to $620 million. In 1985, Forbes assessed Buffett’s total assets at $1 billion.

How old was Warren Buffett when he became a millionaire?

Right now, at 90, he has more than $81 billion in total assets. Notwithstanding, a huge bit of that was gathered after his 50th birthday celebration. Furthermore, $70 billion came after he qualified for Social Security benefits in his mid-60s. The individuals who append the entirety of Buffett’s prosperity to contributing intuition miss a significant point. The genuine key to his prosperity is that he’s been an extraordinary financial backer for 3/4 of a century. Had he begun putting resources into his 30s and resigned in his 60s, hardly any individuals would have at any point known about him. Buffett started genuinely contributing when he was ten years of age.

Image Source: Aroound

At the point when he was 11 years of age, Buffett commenced a long period of contributing by buying his first stock. This future billionaire purchased three portions of the oil organization Cities Service at about $38 per share. Buffett ultimately sold the stock at $40, making a benefit of $2 per share; however, he took in a significant exercise about tolerance when the cost later shot up to $200 per share. When he was 30, he reached a net worth of $1 million, or $9.3 million adjusted for inflation.

What was Warren Buffett worth at 30?

At 30, Warren Buffett owned $1 million, or $9.3 million adjusted for inflation. By 2006, Berkshire Hathaway, under his stewardship, boasted stock values exceeding $100,000 each, propelling Buffett’s personal fortune beyond $40 billion. He pledged 85% of his wealth to the Bill and Melinda Gates Foundation, initiating the Giving Pledge in 2010 with Bill Gates. Over 200 billionaires have since committed half their wealth to philanthropy, totaling over $500 billion. Despite donating $37 billion, Buffett’s wealth surpasses $81 billion today, ranking him sixth globally. Berkshire Hathaway’s shares now exceed $320,000, with a market value exceeding $500 billion, showcasing investments in Amazon, Apple, American Airlines, American Express, Coca-Cola, Procter and Gamble, and General Motors, among others.

FAQs

What is Warren Buffett known for?

Warren Buffett is an iconic figure in the world of finance and investing. He is celebrated for his exceptional investor success and impressive wealth. Buffett is known for his value investing strategy and long-term perspective. He is the Chairman and CEO of Berkshire Hathaway, a multinational conglomerate. In addition to his financial prowess, Buffett is recognized for his philanthropic endeavors. He has committed to giving away the majority of his wealth to charitable causes, leaving a lasting impact on society.

What is Warren Buffett’s secret to longevity in the investment world?

While Warren Buffett’s age is impressive, his longevity in the investment world is attributed to his disciplined investment approach, long-term perspective, and adherence to value investing principles. He emphasizes patience, research, and making informed investment decisions.

How has Warren Buffett’s age influenced his investment strategies?

Warren Buffett’s age has allowed him to accumulate decades of experience and market insights. His long-term perspective and ability to see beyond short-term fluctuations have helped him identify solid investment opportunities and make successful investment decisions.

What asset allocation strategy does Warren Buffett suggest for retirement?

In a 2013 letter to Berkshire Hathaway shareholders, Warren Buffett revealed an investment plan for his wife that differed from conventional retirement advice. He recommended allocating 90% of her funds to a stock index fund and 10% to short-term government bonds. While this approach contradicts the typical advice of reducing stock exposure with age, Buffer acknowledged that it might not be suitable for every investor, emphasizing the need for individual evaluation.

What is Warren Buffett’s take on diversification?

Warren Buffett famously stated that, as commonly practiced, diversification makes little sense for those who understand what they’re doing. He believes it is a protection against ignorance. Instead of spreading investments across various sectors, Buffett advocates for deep knowledge and focused investments in one or two industries. He argues that this approach can be more profitable than broad diversification, allowing investors to capitalize on their expertise and maximize gains. While diversification may help manage risks by offsetting losses, Buffett highlights the limitation it imposes on potential substantial gains from concentrated investments.

What are some of Warren Buffett’s notable achievements despite his age?

Despite his age, Warren Buffett has achieved remarkable success. He built Berkshire Hathaway into a multinational conglomerate, became one of the wealthiest individuals globally, and made significant philanthropic contributions. His annual letters to shareholders and legendary investment performance have garnered admiration.

Conclusion

Warren Buffett’s ventures, though not consistently successful, exemplify a meticulous adherence to value principles. By vigilantly scouting for new opportunities and steadfastly following a consistent approach, Buffett, along with the conglomerate he acquired earlier, stands as one of the most celebrated investment narratives. However, as Buffett himself asserts, one doesn’t need genius to invest profitably over a lifetime. Instead, what’s crucial is a robust intellectual framework for decision-making and the ability to shield that framework from the corrosive influence of emotions.