In today’s digital age, we have many options for sending and receiving money through various online platforms. Snapchat, the popular social media app, has now introduced a new feature that allows users to send money to their friends directly through the app. This new feature, called “SnapCash,” enables users to quickly and easily transfer money to each other without the need to leave the app.

Sending money on Snapchat is a straightforward process. Users can link their debit cards to their Snapchat accounts and send money to their friends in just a few clicks. This feature is particularly useful for those who frequently use Snapchat to communicate with their friends and want to send money easily without having to switch between different apps.

In this article, we will provide a step-by-step guide on how to send money on Snapchat using SnapCash. We will also cover some of the security measures in place to protect users’ financial information and provide tips on how to stay safe while using this new feature. So let’s dive in and learn how to send money on Snapchat.

What is Snapcash?

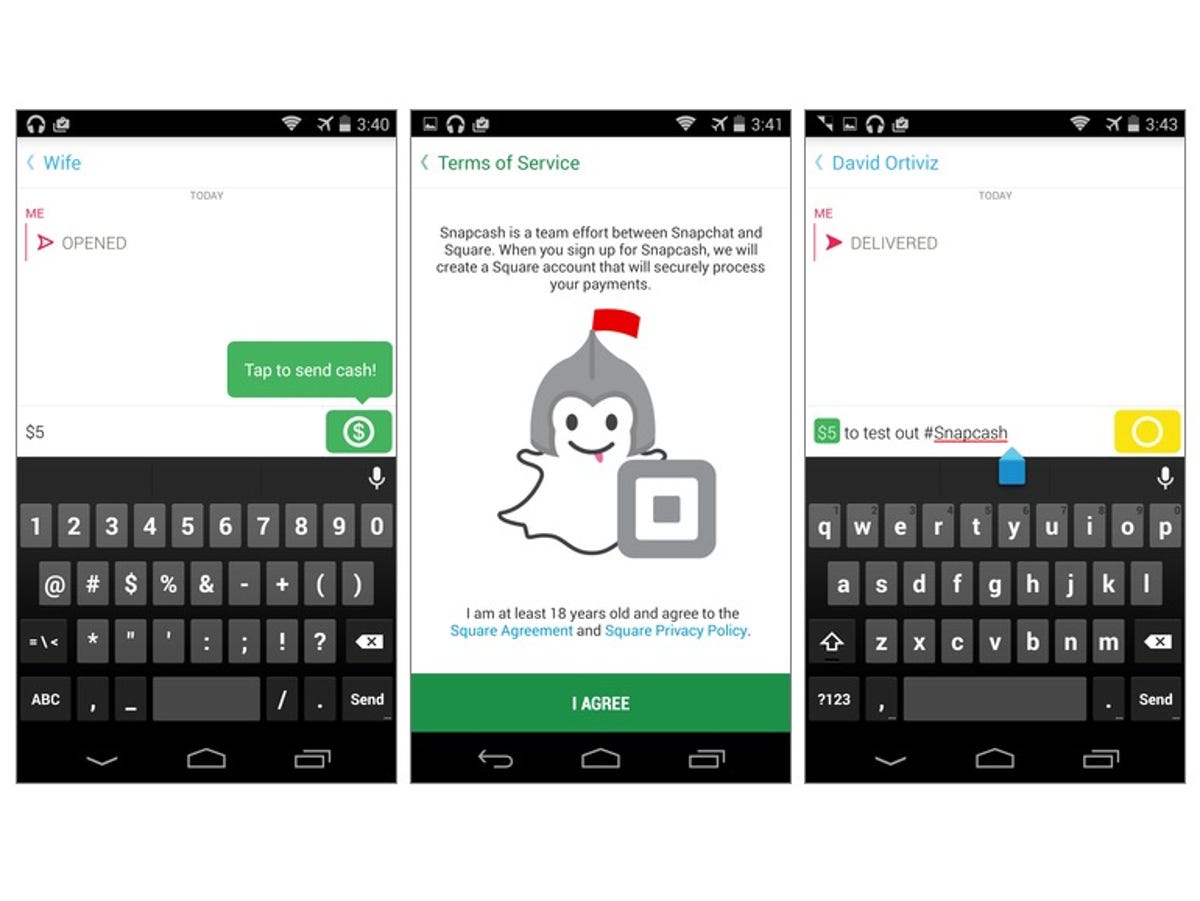

While Venmo, Google Wallet, and more attempt to adopt a business strategy for shared payments, Snapchat recently dove in from the consumer side. It just included a “Snapcash” payment option to its application through a deal with Square Cash. Presently you can include a debit card, type a dollar sum into Snapchat’s text chat highlight, and hit the green play button to send someone (a friend) cash quickly. The element is on Android now and is coming to iOS soon.

It was previously discussed that Snapchat had documented brand names around payments in July, and now we know why. Past p2p payments, the brand names could prime Snapchat for web-based business and payments to dealers also. For instance, the application would one day be able to send you a Snap or show a Story promotion from a merchant and let you purchase the item indicated in a split second through Snapchat. Contingent upon its relationship with Square Cash functions, Snapchat could likewise conceivably cross-reference debit card information through Snapcash-connected accounts to improve its advertisement targeting.

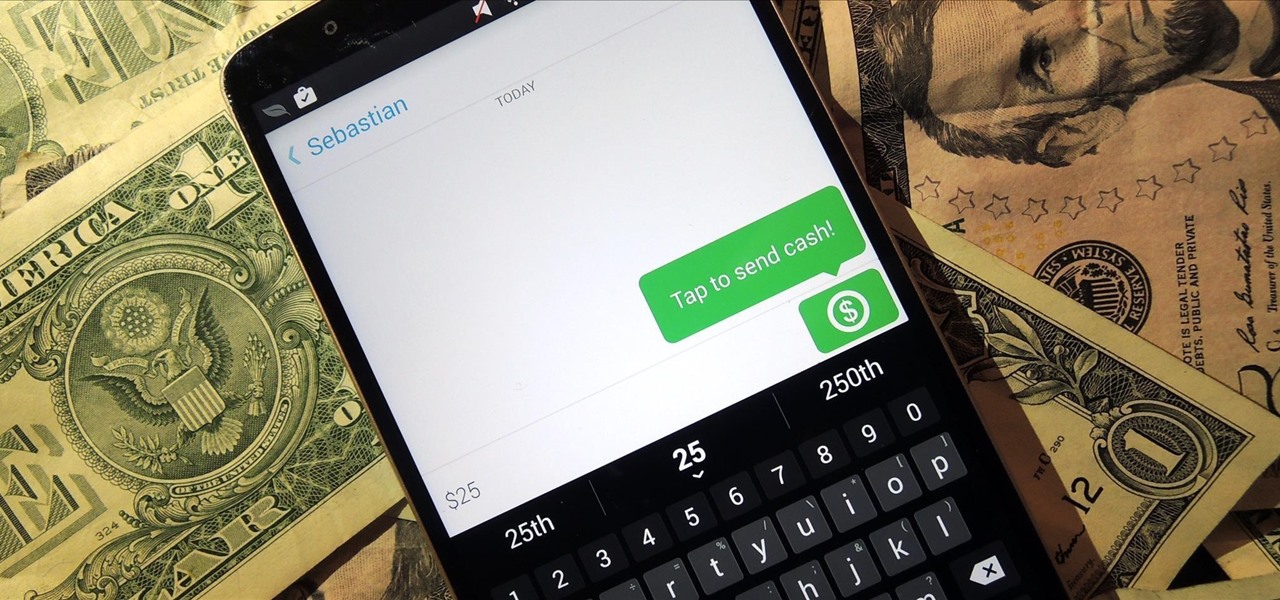

You can perceive how Snapcash functions with some additional routines here:

18+ US clients join by including a Visa or Mastercard debit card. All their account subtleties are held by Square Cash; you don’t need to stress as much over confiding in Snapchat, which has had privacy and security issues in the past.

While in Snapchat text-chat, you type in “$” at that point, the dollar sum you need to send. Snapchat gets notified that you’re attempting to pay, changes the send button to a green Snapcash button, and tapping it stores cash into a friend’s account. That money will be sitting tight for them when they join if they haven’t as of now. If the companion doesn’t acknowledge the payment within 24 hours, the money will be refunded, so you don’t need to stress over losing money.

Can you send money through Snapchat?

Snapcash being highlighted in Snapchat will net Jack Dorsey’s organization image presentation and Mastercard numbers. There might be a financial plan between Snapchat and Square. However, they’re remaining hush-hush on that. Snapchat said it was keen on offering greater payment techniques, for example, Mastercards or ledgers; however, Square just handles Visa and Mastercard debit cards for now.

The Snapcash plan could be massive for Square Cash’s competitive strategy as it attempts to defeat Venmo, Google Wallet, and more for the p2p payments market. None have increased far-reaching buyer adoption, even though they can be exceptionally useful. People use Venmo routinely for splitting meals, beverages, taxis, or outings with friends.

However, by wedging itself into p2p payments through a buyer application that a huge number of individuals now consistently use with their dear companions, Snapcash could infuse itself into the lives of individuals who never considered downloading a fund application.

In 2014, Snapchat banded together with Square to make a simple-to-utilize versatile payment system. For around four years, clients had the option to send and get cash through Snapcash. Nonetheless, this service is not, at this point, accessible and started in late August 2018.

Poorly planned, for what it’s worth, there is no compelling reason to stress over the cash sent through Snapcash before the suspension. Furthermore, there is a shared versatile payment application that Snapchat suggests as a decent other option.

In this article, we’ll investigate what befell the cash that you’ve recently sent. You’ll likewise discover a part about how to utilize Cash App (the previously mentioned other option).

How to receive money on Snapchat?

Image Source: Freepik

Before its discontinuation, receiving and sending money via Snapchat was as simple as linking your debit card to your Snapchat account. The process mirrored that of platforms like PayPal, allowing users to handle transactions even without a linked debit card.

To send money, users could go to any chat, type a dollar sign, and click a button to transfer funds. On the receiving end, Snapchat would alert you, and the funds would immediately be deposited into your linked account.

This feature sounded great, right? However, rumors about Snapcash’s shutdown started circulating in early July 2018, and the service officially ceased on August 30, 2018.

If you hadn’t linked a debit card yet, Snapchat gave you a 48-hour window to do so if you wanted to withdraw your money. Otherwise, the funds would revert to the sender. As a Snapcash user, you also had the opportunity to review your transfer history up to a month after the service ended before it was permanently deleted.

Some ways Snapchat can be used for businesses

Image Source: Pitch Deck Examples

Snapchat is a very useful social media application to use for the promotion of your business. Not only for promotion, but Snapchat can also be beneficial in increasing productivity while conducting business activities. Following are some of the ways you can use Snapchat for your business.

- Use Snapchat to tease product launches: Utilize Snapchat to give your customers a sneak peek of upcoming products or services. This technique, known as “product teasing,” can generate interest and excitement around your business.

- Introduce exclusive coupons: Show your appreciation to your Snapchat followers by offering them exclusive coupons. This incentivizes customer loyalty and encourages them to come to you for business again.

- BTS: Build transparency and trust with your customer base by taking them behind the scenes of your business. This provides insight into your day-to-day operations.

- Customer Service: Provide quick and efficient customer service through Snapchat. This is an effective way to resolve your customer’s issues and concerns.

- Arrange contests and giveaways: Boost customer engagement and interest in your business by hosting contests and giveaways exclusively for your Snapchat followers. This is an effective way to increase customer involvement with your brand.

How to send cash on Snapchat 2023?

Image Source: CNET

To transfer money to someone in your Snapchat contacts, swipe into the chat feature and enter the desired amount you wish to send to your friend or family member in the text chat box. For example, if you want to send $5, simply type that amount into the chat box. Here’s an in-detail method to use this payment system:

- To use Snapcash on Snapchat, simply open a chat with the contact you want to send money to and enter the amount you wish to send.

- Type the dollar amount into the chat window, and Snapchat will recognize it, displaying a yellow send button that activates Snapcash.

- Click the green Snapcash button to complete the transaction and send money to your contact.

- If this is your first time using Snapcash, you will need to link a Visa or MasterCard debit card to your account by entering your card number, CVV, zip code, and expiration date.

- After sending the money, you will receive a notice that the payment has been sent. The recipient must link a debit card to their Snapchat account to accept the payment within 24 hours.

- If the recipient is unable to accept the payment, it will be returned to your account. You can view your Snapcash transactions and edit your debit card settings in your profile settings under “My Account.”

Snapcash is a secure way to send money to family and friends without leaving Snapchat. Square handles all debit card data safely, addressing previous security concerns.

Why is Snapcash going away?

Image Source: TechCrunch

The organization hasn’t unveiled a declaration regarding why it chose to discontinue the shared payment service, nor did it report Snapcash’s use insights.

In any case, one could figure that maybe this is because Snapchat has (presumably unintentionally) become the spot to advertise novice adult content. Subsequently, a few clients may have abused Snapcash to get explicit pictures from different clients.

Given the way that digital marketing is on the ascent, it’s astonishing that Snapchat chose to drop Snapcash. Besides, a code spill uncovered that you might have the option to utilize the Snapchat camera to filter items and be taken directly to Amazon results.

This isn’t equivalent to Snapcash, yet it could be a sort of e-commerce advertising. No matter what, it’s ideal to look at Cash App if you have a soft corner for Snapcash.

What are some alternatives to Snapcash?

Unfortunately, Snapcash is not available anymore, and you can not send money through it anymore. But the good thing is that there are many alternatives to Snapchat that you can use to send to your friends or anyone you are trying to send money to.

- Paypal: PayPal is a widely-used online payment method that enables users to send and receive money with several features. It allows you to send money to your contacts and those without a PayPal account and boasts numerous security features to keep your money safe.

- Skrill: Skrill is another payment app that allows online payments and money transfers to friends and family, and it also provides a prepaid mastercard that you can use for online or in-store shopping. With Skrill, you can hold and exchange multiple currencies in your Skrill account.

- Google Wallet: Google Wallet is a payment solution offered by Google that allows users to send and receive money via their email addresses. It includes additional features such as storing your credit and debit cards to make online and in-store purchases.

- Apple Pay: Apple pay is a payment option offered by Apple that enables users to make payments using their iPhone or Apple watch, and it is available in several countries. Apple allows its users to make payments in stores, online, or through the app. It provides added security by using your fingerprint or passcode to confirm purchases.

- Venmo: Venmo is a popular payment app in the US that enables users to send and receive money from friends. It includes features such as using a credit or debit card and making purchases using your Venmo balance.

- Square Cash: Square Cash is a payment app that lets you send and receive money with just an email address or phone number, and it is available in the US. Square Cash allows users to link their bank accounts and use their debit or credit card to make payments.

- Samsung Pay: A Samsung payment solution that permits you to use your Samsung smartphone to make contactless payments in stores, apps, and websites. It is currently available in 24 countries, including the UK, Australia, Brazil, Canada, China, France, Hong Kong, India, Italy, Russia, Singapore, South Korea, Spain, Sweden, Switzerland, Taiwan, the UAE, the US, and Vietnam. With Samsung pay, you can make payments by holding your phone near the contactless reader and using your finger or passcode to confirm the transaction.

FAQs

Image Source: Helpjuice

How to send money using a Cash App?

Cash App is a mobile payment app that enables users to send and receive money. To send money using the app, select the “Send” button, enter the amount you want to send, and click “Cash Out.” Choose the recipient from your contacts or enter their phone number or email address. Once done, click the “Send Money” button. To receive money using the Cash App, click the “Receive” button in the app.

How do I send money on Snapchat in 2023?

In 2023, there will be various methods to send money on Snapchat. Users can still use the Snapcash feature built into the app or use third-party apps like Venmo. To use Snapcash, go to the chat screen, tap the dollar sign, enter the amount you want to send, and click the blue “Send” button.

Can I make payments on Snapchat in 2023?

Snapcash service is no longer available so you can’t make payments through that. But you can use other third party apps to make your payments like venmo etc.

What is Snapchat’s payment method?

Snapchat has not officially announced its payment method. However, it is rumored that the app will use a third-party payment processor like PayPal or Stripe to avoid traditional credit card processing fees.

How to use Snapcash?

To use Snapcash, download the Snapchat app, create an account, and click the yellow “dollar” symbol in the top right corner. Enter the amount you want to send and click “send.” The recipient must then enter their debit card information to complete the transfer.

Why can’t I send money on Snapchat?

Sending money is not the primary function of Snapchat, which focuses on messaging and photo sharing. However, various other apps and services are available that enable money transfers.

Why isn’t Snapchat sending messages?

Snapchat has been experiencing issues lately with messages not sending or being received. This could be due to incorrect contact information, glitches in the app, or other technical difficulties.

Conclusion

Snapchat makes sending money effortless with its Snapcash payment feature. To get started, simply link your debit card and establish a PIN. Then, sending money is as easy as entering an amount and choosing a recipient directly within the app.

Keep in mind, Snapcash availability varies by country and comes with certain limitations on transaction amounts. Yet, for users with access to it, Snapcash offers a quick and straightforward way to transfer funds to friends on this widely-used social media platform.