Have you ever wondered about the right way of how to endorse a business check? Dive into our guide for expert tips on securing transactions effortlessly. Boost your financial confidence now!

Hey there! Welcome to our guide on how to endorse a business check. Whether you’re a pro or just starting a business, knowing how to support a review is super important. In this post, we’ll break down the steps and challenges, making sure your money moves stay smooth and trouble-free.

Endorsing a business check might seem tedious, but a messy signature can cause many problems. Imagine your bank rejects the bill because your signature is a mess – delays and disputes galore. No worries, though! We’ve got your back with some practical tips to avoid these headaches.

First things first: your signature. It’s not just a scribble; it’s your ticket to a problem-free transaction. If your signature is messy, banks might say no to your check. We’ll show you how to make your signature work for you, avoiding processing issues.

Only on-time or missing endorsements can ensure your money matters are handled smoothly. Banks want things appropriately done for secure dealings. We’ll tell you why endorsing checks on time, whether for deposit or payment, keeps everything running smoothly.

Different checks need different endorsements, and not following instructions can lead to confusion. We’ll discuss why paying attention to what the issuer says is crucial. Following their guidelines ensures you know how to endorse a business check intended for use.

By the end of this guide, you’ll be ready to handle check endorsements confidently. No more messy signatures or late endorsements – just smooth sailing through your business check adventures. Let’s jump in and make endorsing business checks a breeze.

How to endorse a business check?

If you ever wondered how to endorse a business check, don’t worry—it’s common to feel unsure. Let’s simplify the process for smooth and secure transactions.

Grasping the basics

What’s a business check endorsement?

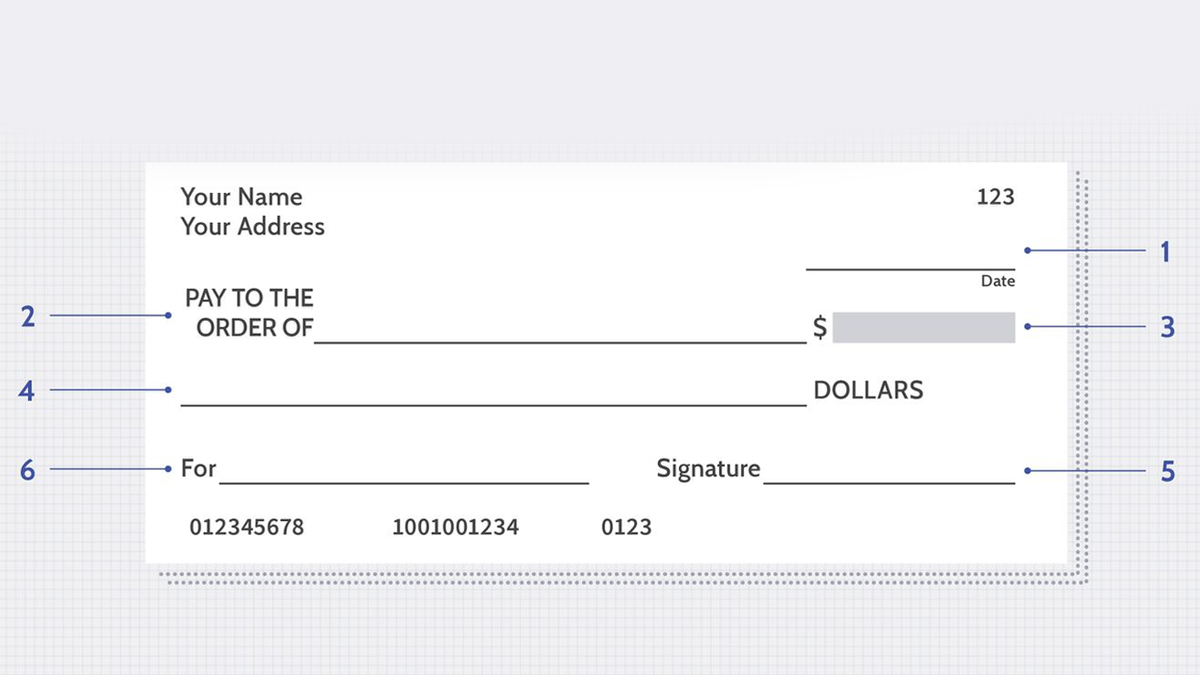

Endorsing a business check means signing the back to confirm it’s legit and ready for transfer. There are three types: blank, restrictive, and unique, each serving a specific purpose.

Easy steps to endorse a business check

Check inspection:

Look over the check before endorsing. Confirm payee details and amounts to avoid endorsement errors.

Pick an endorsement type:

Choose between blank, restrictive, or special endorsements based on your needs. Blank for general use, restrictive or particular for more control.

Signature time:

Sign your name on the back’s designated line. Keep it consistent to avoid any hiccups.

Add extra info (if needed):

Depending on the endorsement type, throw in account numbers or restrictions if required. Always follow specific instructions.

Keep it safe:

Once endorsed, your check is a negotiable instrument. Handle it securely to prevent unauthorized use and safeguard your financial transactions.

Everyday oops moment to dodge

Late or missing endorsement:

Ensure a prompt endorsement to avoid hassles. Late or missing endorsements can cause transaction delays.

Clear signature matters:

A clear, consistent signature is a must. Illegible ones can lead to disputes or rejection by financial institutions.

Follow instructions:

Different situations need different endorsements. Ignoring these may result in processing errors.

The simple truth

Now that you’ve got the basics of endorsing a business check, do it confidently. Understand the endorsement type, follow the steps, and enjoy smooth, secure transactions. Confidently support those checks and breeze through the financial landscape.

Understanding how to endorse a business check is indispensable for entrepreneurs in business transactions.

Check made out to wrong business name

Receiving a check with the wrong business name can be puzzling, but worry not—let’s guide you through the steps to handle this common hiccup. Knowing how to endorse a business check is a pivotal skill that ensures the smooth flow of funds within your company.

Why did it happen?

Understanding common causes:

Mistakes occur, and checks might bear incorrect names due to typos, outdated information, or misunderstandings. It’s more common than you think.

What you can do

Contact the issuer:

If the check is from a client or customer, contact them promptly. Politely clarify the error and request a corrected statement with the accurate business name.

Bank inquiry:

Contact your bank and explain the situation. Some banks may accept checks with slight name variations, but confirming this beforehand is crucial.

Endorsement considerations:

Before endorsing, ensure the name variation will avoid complications. If you need more certainty, consult your bank to prevent potential issues.

Common pitfalls to avoid

Ignoring the issue:

Pay attention to address the problem promptly to avoid delays or complications in cashing the check.

Unclear endorsements:

Be cautious when endorsing. Endorse the check under the correct business name to ensure clarity.

Lack of communication:

Maintaining open communication with the issuer and your bank is critical to resolving the issue efficiently.

While receiving a check with the wrong business name might raise concerns, it’s a manageable situation. Proactive communication and swift action can often lead to a resolution. Remember, clarity and openness are your allies in navigating this common challenge. Mastering the art of how to endorse a business check requires precision and adherence to banking protocols.

How to endorse a business check for mobile deposit?

In today’s digital age, endorsing a business check for mobile deposit offers convenience. Let’s guide you through the simple steps to make this process seamless.

What do you need?

In a fast-paced digital era, leveraging mobile deposit for business checks isn’t just a convenience – it’s a strategic move. Save time, increase efficiency, and streamline your banking processes with this modern solution tailored to meet your business needs. To endorse a business check for mobile deposit, follow these simple steps:

A mobile banking app

Ensure your bank provides a mobile banking app compatible with mobile check deposits. Download and install it on your smartphone.

A good quality camera

Clear, well-lit photos enhance the mobile deposit process. Make sure your smartphone’s camera is in good working condition.

Step-by-step method: How to endorse a business check?

Open your mobile banking app

Launch the app on your smartphone and log in to your business account.

Locate the mobile deposit feature

Look for the mobile deposit option within the app’s menu. A camera icon often represents it.

Enter check details

Provide the necessary information, including the check amount and the account to which you want the funds deposited.

Capture images

Follow the app’s prompts to capture images of the front and back of the endorsed check. Ensure the endorsement is clear and readable.

Verify information

Review the entered details for accuracy. Confirm that the endorsed check matches the information on the app.

Submit your deposit

Once satisfied, submit your deposit through the app. Your bank will process it, and you’ll receive a confirmation.

Common tips for success

Endorse correctly

Always endorse the check on the back before capturing images. Include phrases like “for mobile deposit only” along with your signature.

Use good lighting

Photograph the check in a well-lit area to ensure clear, legible images.

Ensure check legibility

Ensure the check is free of any marks or damages hindering mobile deposit.

Security measures

Clear check after deposit

Store the physical check securely after depositing it through the mobile app.

Protect personal information

Be cautious about where and how you capture check images to avoid unintentional exposure of sensitive information.

Regularly monitor your account

Monitor your business account to detect and address any irregularities promptly.

Mobile check deposits have simplified banking for businesses. By following these steps and considering the tips, you can confidently endorse a business check for mobile deposit, saving time and adding convenience to your financial management.

How to endorse a business check involves signing your name exactly as it appears on the front of the examination.

How to hand over a business check to someone else?

Sometimes, you need to pass a business check to someone else. Let’s break down the easy steps for a smooth and precise transfer. The nuances of how to endorse a business check extend to the subsequent actions required for depositing the check.

0f sasd0

Why hand it over?

Common situations

You might need to pass on a business check for various reasons, like sharing financial duties or dividing funds with business partners.

Step-by-step walkthrough

1. Check with your bank

First off, chat with your bank. Get the lowdown on their rules for transferring business checks. Every bank may have different needs.

2. Sign and note

Flip the check and sign your name on the back like it’s on the front. Add a plain and unambiguous note saying you’re endorsing the bill to someone else.

3. Receiver’s turn

Tell the receiver to endorse below your signature. They should scribble a note, too, saying the check is moving over to them.

4. Extra info (if needed)

Some banks want more details, like account numbers or extra permissions. Both of you, sender and receiver, cover all bases.

5. Hand it to the bank

Take the endorsed check to your bank. The receiver might need to pop it into their account.

Things to remember

1. Banks have their rules

Every bank dances to its tune when passing on business checks.

2. Speak clearly

Tell the receiver why you’re handing them the check. Explicit chats prevent any head-scratching moments.

3. Check your authority

Double-check—you’ve got the green light to endorse the check for your business.

Watch out for pitfalls

No sneaky moves:

Make sure you’re allowed to pass the check on. Unexpected endorsements can stir up trouble.

Don’t miss a beat:

Put down all the details and a clear note. Confusion is the last thing you want.

Keep talking:

Stay in the loop with the receiver. No one likes surprises, especially in the financial world.

Passing on a business check is something other than rocket science. Stick to this guide, know what your bank wants, and you’ll smoothly hand over funds and share financial duties when needed. How to endorse a business check is not just about the signature; it’s about dotting the i’s and crossing the t’s for a seamless deposit experience.

How to endorse a business check over to a third party?

The process may be when you must pass a business check to a third party.

Why endorse a third party?

Common scenarios:

Sometimes, you might need to endorse a business check to a third party, whether it’s for collaboration, payment distribution, or other shared financial responsibilities.

Step-by-step guide

1. Bank consultation:

Start by checking with your bank. Understand their specific rules and requirements for endorsing business checks to a third party.

2. Your initial endorsement:

On the back of the check, sign your name as it appears on the front. Include a clear note stating that you endorse the bill to a third party.

3. Third-party endorsement:

Instruct the third party to endorse the check below your signature. They should also add a note indicating that the review is in their possession.

4. Provide necessary details (if needed):

Some banks may require additional information, such as account numbers or authorization. Make sure both you and the third-party comply with any such requirements.

5. Submission to the bank:

Take the endorsed check to your bank for processing. The third-party might need to deposit it into their account.

Key considerations

1. Bank policies vary

Remember that banks have different policies regarding endorsing business checks to third parties. Be aware of the rules.

2. Communication is key

Please communicate with the third party about endorsing the check to them. It helps ensure clarity and time.

3. Authorization check

Ensure you have the proper authorization to approve the check on behalf of your business and pass it on to a third party.

Pitfalls to avoid

Unauthorized endorsement

Ensure you have the authority to endorse the check to a third party. Unauthorized endorsements can lead to complications.

Incomplete documentation

Include all necessary information and an explicit note to avoid confusion and ensure a seamless process.

Lack of communication

Keep the lines of communication open with the third party to prevent misunderstandings or delays.

Endorsing a business check over to a third party involves a few steps. By following this guide, staying informed about your bank’s policies, and communicating effectively, you can confidently transfer funds and share financial responsibilities when needed. Incorporating electronic options into how to endorse a business check can enhance the efficiency of your financial transactions.

How to pass a business check to another business?

When moving money between businesses using check endorsement, let’s break down the steps for a smooth process. Navigating the world of business finance with confidence and finesse starts with mastering how to endorse a business check.

Why hand it over to another business?

Typical business scenarios:

Sometimes, you must hand over a business check to another business—maybe for a joint project, partnership, or shared costs.

Step-by-step walkthrough

1. Check the bank rules:

Start by peeking at your bank’s rules. Each bank dances to its tune when endorsing business checks to other businesses.

2. Your first signature:

Turn the check over and sign the back with your business name just like it’s on the front. Stick a clear note saying you’re passing it to another business.

3. Receiver’s move:

Tell the other business to sign below your scribble. They should note that they’ve got their hands on the check.

4. Extra info (if needed):

Some banks might want more info, like account numbers or specific permissions. Both sender and receiver businesses ensure you’re ticking all the boxes.

5. Off to the bank:

Take the check to your bank for the magic touch. The other business can then drop it into their account.

What to keep in mind?

1. Bank rules are game-changers:

Remember, every bank plays by its own set of rules. Could you get to know them to avoid any missteps?

2. Speak the same language:

Chat clearly with the other business. Let them know why you’re passing the check to prevent head-scratching.

3. Check the permission slip:

Ensure both businesses are clear enough to sign and receive the check.

Watch out for slip-ups

No sneaky moves:

Both businesses need the green light to sign and receive the check. Unauthorized moves can cause a stir.

Details matter:

Jot down all the details and a note. Clarity is your best friend in financial dealings.

Keep the line open:

Stay in touch with the other business. Smooth communication prevents misunderstandings or delays.

Passing a business check to another business isn’t rocket science. Stick to this guide, get cozy with your bank’s rules, and you’ll smoothly transfer funds and share expenses between firms.

Understanding how to endorse a business check is akin to wielding a powerful tool that ensures the seamless flow of funds in your professional endeavors.

How to sign a business check from Wells Fargo?

The endorsement steps are straightforward when dealing with a Wells Fargo Business check. Let’s walk you through the process for a smooth experience. Knowing how to endorse a business check involves more than just a simple signature; it demands precision and adherence to banking protocols. The first step is to locate the designated area on the back of the check specifically meant for endorsements.

Wells Fargo guidelines

Get to know the rules:

First things first, check out what Wells Fargo wants when it comes to endorsing business checks. Each bank has its own way of doing things.

Step-by-step guide

1. Specifics to look for:

Dive into Wells Fargo’s endorsement requirements. Head to their official website or chat with customer service to catch any particular criteria.

2. Your first signature:

Flip the check and scribble your business name on the back like it’s on the front. Tack on a note saying you’re giving the bill your stamp of approval.

3. Passing the baton:

If the check is headed to another business, guide them to sign under your autograph. They should drop a note in there mentioning the handover.

4. Extras (if needed):

Wells Fargo might ask for more details, like account numbers or special permissions. Make sure everything’s in order.

5. Off to Wells Fargo:

Take the check to your closest Wells Fargo spot or use their mobile app to cash in. They can use the same process if it’s going to another business.

Tips for a smooth ride

1. Recheck the rules:

Always double-check what Wells Fargo wants at the moment. Make sure your endorsement lines up with their playbook.

2. Talk the talk:

If you’re passing the check on, have a good chat about why you’re doing it. Clear communication avoids any head-scratching moments.

3. Go mobile:

Jump on Wells Fargo’s app for quick check deposits. Snap some sharp pics of the signed check for a breezy mobile deposit.

Hurdles and fixes

1. Don’t miss the deets:

Have all the necessary info, signatures, and notes in place. It avoids any hiccups in processing.

2. Click smart for mobile deposits:

If you’re going the mobile route, get good lighting for the check pics. Clear images mean smooth processing.

3. Stay in the loop:

Keep an eye out for updates to Wells Fargo’s rules. Staying informed prevents any surprises in the endorsement game.

Signing a business check from Wells Fargo is a breeze. Stick to these steps, know Wells Fargo’s rules, and make the most of handy options like mobile banking. You’ll handle business checks with confidence and ensure a seamless financial experience.

Once you’ve secured your position on the check, the next crucial step in how to endorse a business check is to sign your name exactly as it appears on the front.

Exploring different check endorsements

When you’re dealing with business checks, it’s crucial to know the various endorsement types. Let’s dive into these categories to make your journey through check endorsements smoother.

If your business involves multiple stakeholders, harmonize the endorsement process to ensure all authorized signatories are aligned. The complexity of how to endorse a business check extends beyond the signature; it delves into the subsequent steps required to transform that piece of paper into tangible funds in your business account.

Blank endorsement

What’s it?

A blank endorsement is essential. Just sign the back without specifying a payee. The check becomes like cash, so anyone holding it can cash in.

Tip for you:

If you’re going blank, play it safe. Only endorse at deposit or payment time to minimize loss or unauthorized use risks.

Restrictive endorsement

Adding security:

A restrictive endorsement adds a layer. Write “for deposit only” and your account number. It keeps the check on a tight leash, ensuring funds go straight to your account.

Your move:

Use this endorsement when mailing checks or depositing in ATMs to cut the risk of theft or unauthorized use.

Special endorsement

Also called:

Known as a specific endorsement, a special blessing points the check to a particular person or entity. Instead of a generic signature, write “pay to the order of [name]” followed by your signature.

Your trick:

Deploy special endorsements when you want precise control over who can cash or deposit the check.

Multiple endorsements

Chain of signatures:

Multiple endorsements involve a series of signatures from different parties. Each one adds authorization, creating a chain of ownership. It happens when checks pass through various businesses or hands.

Your watch:

With multiple endorsements, keep your eyes peeled. Ensure all signatures and permissions are in place to dodge any processing bumps.

Power in knowledge:

Knowing these endorsement types lets you pick what fits your needs. Whether it’s a blank, restrictive, special, or multiple endorsement, align it with your control level for smoother business transactions.

Incorporate these endorsement types into your money management. Feel confident handling business checks, ensuring secure and efficient transactions just how you like.

This crucial step ensures the bank can verify your identity, adding an extra layer of security to the transaction. How to endorse a business check isn’t just about the signature; it’s about navigating the deposit process with finesse.

Navigating common hurdles in check endorsement

Endorsing a business check might seem easy, but there are some tricky parts. Let’s look at the common problems you could face and how to handle them. How to endorse a business check has evolved, providing convenient electronic options for those who prefer a digital approach.

Messy signatures: No good

Problem: If your signature is messy, the bank might not like it. They could reject the check or cause delays if it doesn’t match their records.

Solution: Keep it simple. Make your signature clear and the same every time. It helps avoid problems and keeps your transactions smooth.

Late or missing endorsements: Not cool

Issue: If you wait too long to endorse a check, or worse, forget to do it, things get complicated. Banks need the proper endorsements for safe transactions.

Move: Endorse the check on time, whether for deposit or payment. Doing it promptly helps everything go smoothly without unnecessary delays.

Ignoring endorsement instructions: Risky business

Pitfall: Sometimes, checks need specific endorsements. If you pay attention to these rules, mistakes can happen, causing confusion and issues.

Approach: Read and follow any instructions given by the issuer. It ensures your endorsement fits the check’s intended use.

Unauthorized use: Big risk

Danger: If you don’t sign a check on time, someone could use it without permission. It is especially true for checks with blank endorsements.

Defense: Sign your checks when you deposit or use them. This small step adds a layer of security to your financial transactions.

Conclusion: Be proactive

To handle check endorsements smoothly, be ready for these common issues. Ensure your signature is clear, endorse on time, and follow instructions. Being proactive keeps your financial transactions safe from possible problems.

In conclusion, mastering how to endorse a business check is a fundamental skill that elevates the efficiency of your financial transactions. Approach the process precisely, adhere to banking protocols, and leverage electronic options.

FAQs: How to endorse a business check?

How to endorse a business check?

Flip it over to endorse a business check and sign your name on the back. Keep it clear and the same every time to avoid problems. A neat signature is super essential for smooth transactions. When you sign, ensure it matches the records to avoid delays.

Why is an unclear signature a problem?

If your signature is messy, it can cause arguments, and the bank might say no to the check. The process could slow down if your signature doesn’t match their records. So, ensure your signature is clear and stays the same to keep your transactions smooth.

What happens if I miss or delay the endorsement?

Things get complicated if you wait too long or must remember to endorse the check. Banks need the proper endorsements to keep transactions safe. So, sign the bill on time, whether for deposit or payment. Doing it quickly helps everything run smoothly without any unnecessary delays.

Are there specific instructions for endorsements?

Yep, different situations need different endorsements. You need to pay attention to the rules to avoid confusion and mistakes. Read and follow any instructions given by the issuer. It makes sure your endorsement fits the check’s intended use.

How can I prevent the unauthorized use of a check?

If you don’t sign a check on time, someone might use it without permission, especially if it has a blank endorsement. Sign your bills when you deposit or use them. It adds a layer of security to your financial transactions.

What are the key takeaways for endorsing a business check?

Be proactive! Make sure your signatures are clear, endorsements are on time, and you follow any instructions. Fixing messy signatures, avoiding late endorsements, and following the rules reduce the chances of problems in your financial transactions. Confidence in endorsing business checks keeps you safe from potential pitfalls.

Final thoughts

So, did you make it through our guide on how to endorse a business check? Now, you have insider info to handle endorsements like a pro. Let’s quickly review the necessary stuff to keep your money moving smoothly.

Your signature? It’s not just a doodle—your approval for money matters. Keep it tidy and consistent to dodge disputes and check rejections. A clean signature sets the stage for transactions without the headaches.

Quick endorsements are the secret sauce for a breezy financial ride. Whether you’re depositing or making a payment, endorse that check pronto. Banks dig it, and you’ll love the fuss-free process.

Different checks, different rules. Following the guidelines from the issuer is your GPS. It ensures your endorsement fits like a glove, slashing the risk of mix-ups and errors.

So, by being on top of things—clearing up messy signatures, never missing a beat on endorsements, and sticking to the rules—you’ve slashed the chances of financial hiccups. With this know-how, step out there confidently and make your business how to endorse a business check? A walk in the park. Your money journey just got a whole lot smoother!